Highlights

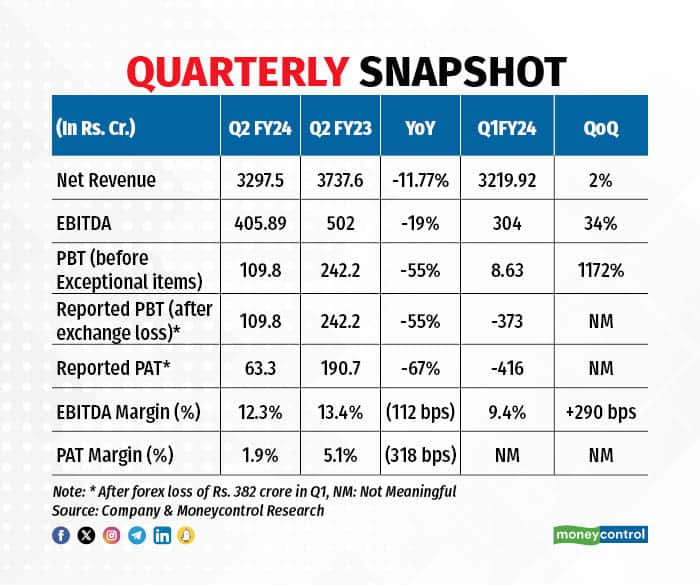

After suffering huge loss due to the Nigerian currency devaluation in the previous quarter, the September quarter saw a healthy volume recovery and a sharp growth in margins, sequentially. The company recorded a net profit of Rs 63 crore in Q2 FY24 against a net loss of Rs 416 crore in Q1 FY24.

The domestic packaging films market remains robust, while the global business will start seeing an upturn in the coming quarters.

Q2 FY24 Update:

Healthy volume growth, momentum to continue

Although the performance of the packaging film business was flat on a YoY basis, the shift in focus towards regaining volumes aided healthy sequential growth in Q2 (up 6.6 percent).

The flexible and liquid packaging business continues to perform well on the back of strong demand from the FMCG segment. The quarter saw a 21 percent QoQ volume growth.

The management strives to increase utilisation across businesses and targets a sequential volume growth in the 7-8 percent range in the packaging film. It hopes to maintain growth in the flexible packaging business in the second half of the current fiscal (H2 FY24).

The aseptic packaging continued its strong run, backed by orders from new customers. The de-bottlenecking of the aseptic packaging plant will help in expanding the capacity to 12 billions pack by September 2024 end from the current 7 billion packs.

Sharp recovery in margins

Globally, European margins remain below expectations, while America saw higher margins in Q2. The trend is expected to continue.

In the domestic market, BoPP (biaxially oriented polypropylene) saw healthy margin recovery. However, given the lean quarter for liquid packaging, aseptic packaging margins were down and will likely improve after December.

That said, the aseptic business looks very promising with higher margin contribution and capacity addition will likely aid top-line growth in FY24.

The consolidated EBITDA margin of 12.3 percent in Q2 was well within the guidance. It increased by 290 basis points QoQ, primarily driven by a better domestic performance across businesses.

In the near-term, the management targets an EBITDA margin in the 12-12.5 percent range by Q3 FY24 and 13.5 percent by Q4 FY24.

Outlook and valuation

Uflex is a revered global leader with a large array of products, coupled with a diversified packaging value chain. The company is trodding the path of innovation in the fast-paced packaging sector, adding new products every year.

The European market remains sluggish, while in India overcapacity is driving pricing and margins down. Barring the near-term uncertainty, we believe that Uflex’s well-integrated business model will drive better performances on a consolidated basis, going forward.

The aseptic business looks very promising with higher margin contribution (margins in the high-teens range) and will aid margin growth in the H2 FY24. The Asepto (liquid packaging brand) expansion was delayed due to equipment shortage and will be commissioned by the Sep-Oct period of 2024.

Moreover, captive projects to manufacture PET chips (capacity of 140k tonnes per annum) for BoPET films (biaxially oriented polyethylene terephthalate, a polyester film made from stretched polyethylene terephthalate (PET) is on track and is likely to be operational by FY24 end. This will enhance packaging film margins by around 1.5 percent in FY25.

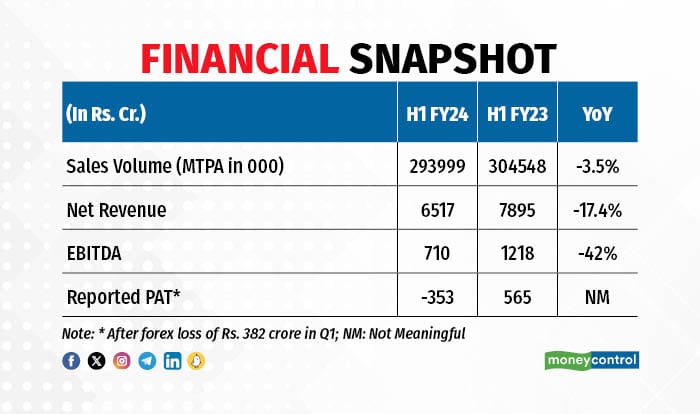

On a consolidated basis, total revenue is expected to decline by around 10 percent and the target EBITDA margin is in the 11.5 percent range in FY24.

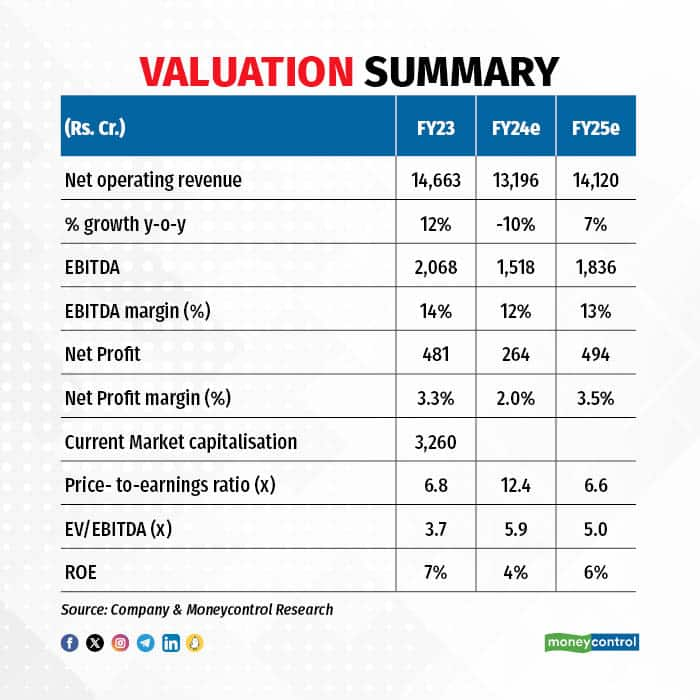

The sector as a whole remains undervalued at a multiple of 4-5 times EV/EBITDA ratio in the past one year. The revival in demand and margins could lead to the sector’s re-rerating.

On the valuation front, Uflex is trading at 5.0 times EV/EBITDA and 6.6 times P/E on FY25e earnings. This is reasonable, considering the potential earnings growth.

We advise investors to consider it as a long-term buying opportunity.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now