Highlights

This was anticipated as the regulator had earlier flagged concerns over the runaway growth in unsecured credit in the past few years.

The move will surely slow down the growth in consumer credit and adversely impact the earnings of banks and NBFCs.

Consumer loans and credit card receivables to attract higher risk weight

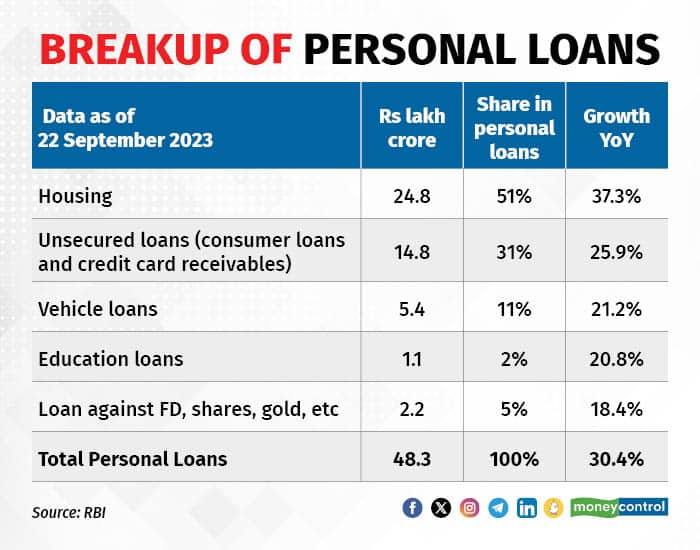

The regulator increased the risk weights on consumer/personal loans extended by banks and non-bank finance companies (NBFC) from 100 percent to 125 percent. The higher risk weights will be applicable on all outstanding as well as new consumer credit exposure. Consumer credit consists of unsecured personal loans and excludes housing loans, educational loans, vehicle loans, loans against gold jewellery, and micro-finance loans.

Also Read: Banks, NBFCs may raise rates after RBI’s action on consumer loans, experts say

The RBI also increased the risk weights on credit card receivables by 25 percentage points to 150 percent and 125 percent for banks and NBFCs respectively.

Moreover, lenders have been asked to treat all top-up loans extended against movable assets, which are depreciating in nature, as unsecured loans for credit appraisal. The regulator wants lenders to review the exposure limits for consumer credit and put in place board-approved limits in respect of various subsegments under consumer credit.

Bank credit to NBFCs will require more capital

In the case of bank loans to NBFCs that carry a risk weight under 100 percent, the RBI has increased the risk weights by 25 percentage points (over and above the risk weight associated with the given external rating).

What does the regulatory change imply?

As per the regulations, scheduled commercial banks and NBFCs must keep aside some capital to cover the credit risk incident, if any. The increase in risk weight means more amount of capital will need to be set aside by the lenders for consumer lending.

The change will make unsecured personal loans more expensive and will slow down lending to these segments.

While the growth of banks and NBFCs will be impacted, there is no direct hit to profits by this move. Increased risk weights is a softer move against higher provisioning on unsecured loans which could have hit profitability directly.

RBI wants to keep a check on growing consumer loans

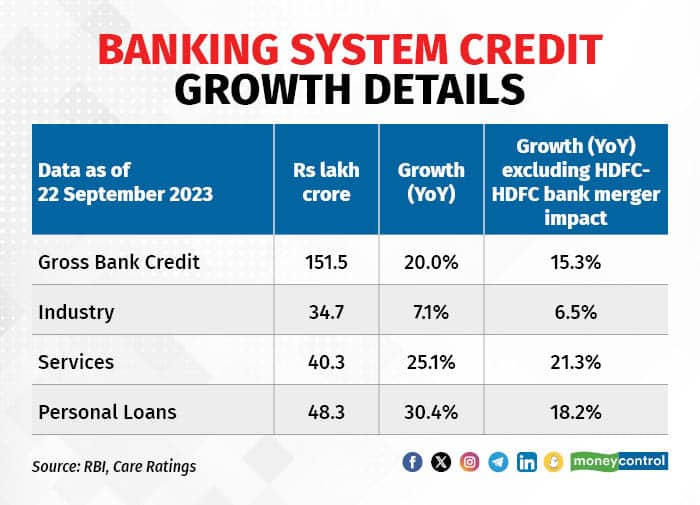

Retail loans have been a major driver of bank credit in recent years. Retail loans grew at a compounded annual growth rate (CAGR) of 24.8 percent from March 2021 to March 2023, almost double the CAGR of 13.8 per cent for gross advances during the same period.

After housing, unsecured loans are the second largest component in the retail loan segments and continues to grow at a faster pace than overall credit.

Unsecured retail loans now forms around 10 percent of the total banking system credit.

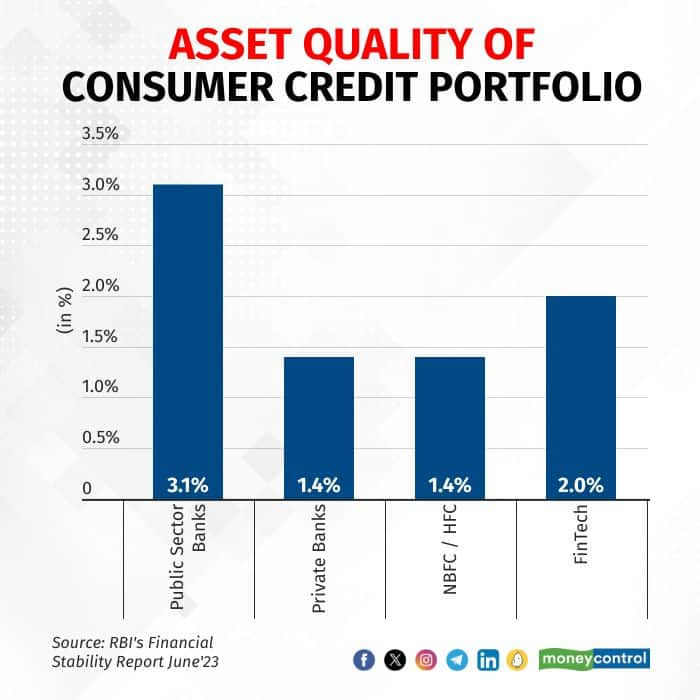

The proportion of portfolios at 90 dpd (days past due) or beyond, which serves as a measure of impairment in consumer credit, has improved during FY23.

However, the share of special mention accounts (SMA) for unsecured loans is high at 7 percent for banks as per RBI. Also, below-prime consumers constituted around 46.9 percent of total credit active consumers as of March’23 for banks as stated in the RBI's Financial Stability Report of June'23.

So, while unsecured credit does not pose an imminent risk to systemic stability, the regulator does not want to overlook the potential stress.

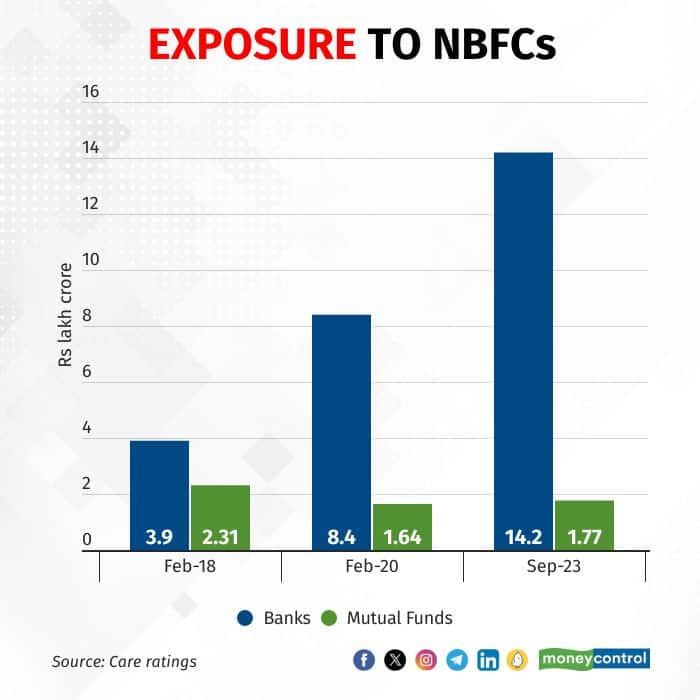

Funding cost for NBFCs will go up

The credit extended by banks to NBFCs has exhibited a consistent upward trend over the last five years and continued to accelerate in the current fiscal. Consequently, bank borrowings remained the principal source of funds and constituted 41.2 percent of the total borrowings of NBFCs (excluding core investment companies) as at end March'23 as per RBI's Financial Stability Report. Large NBFCs focused on the capital market for funding needs, while mid-sized and smaller NBFCs, particularly those rated below the highest levels, depends heavily on the banking system as their primary source of funding.

Compared to February 2018 numbers, absolute bank lending to NBFCs has jumped almost 3.5x. Meanwhile, the mutual fund exposure has reduced over the last five years due to risk aversion by mutual fund managers.

Which stocks will be the most impacted?

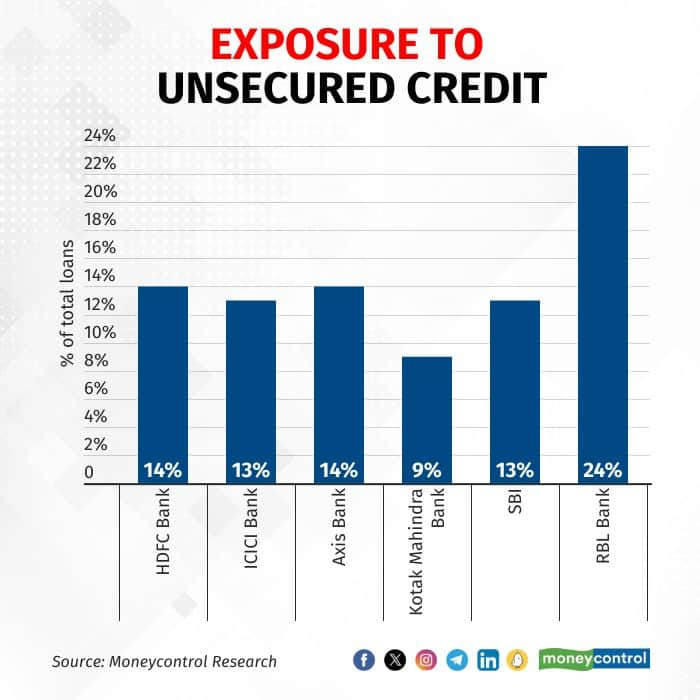

Banks with relatively high exposure to unsecured loans (ICICI Bank, RBL Bank, HDFC Bank, Axis bank, SBI) will be impacted. But lenders with relatively less capital adequacy (SBI) will be at a higher disadvantage. A bank like CSB Bank, which is predominantly into gold financing, will see the least impact. Kotak Mahindra bank is relatively better placed with least consumer credit exposure among the large private banks.

Among the NBFCs, Bajaj Finance will be hit the most as consumer credit constitutes 34 percent of its portfolio, while NBFCs into vehicle financing (Cholamandalam, Mahindra Finance) will be less impacted. However, Bajaj Finance raised equity capital of Rs 8,800 crore recently, despite healthy capitalisation, which will provide the cushion.

Aditya Birla Capital has been aggressive in growing unsecured loans and hence will feel the heat of the RBI move. Housing finance companies and micro-finance lenders will not be impacted by the regulatory change. However, SBI Cards, being into a mono-line business, will be hit by the RBI’s move.

That said, all NBFCs could see the cost of funds moving up as banks will increase the lending rates to offset the impact of higher capital charges.

Overall, the RBI move is aimed at putting brakes on runaway growth seen in consumer lending and will lead to slower advances growth for banks and NBFCs. It remains to be seen how the move impacts the overall consumption in the economy, especially high-end consumption, that were partially fueled by an unsecured credit boom.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now