Highlights

Tata Power (CMP: Rs260 Market capitalisation: Rs 83,110 Crore, Stock Rating: xxxx)is deploying a lot of capital upfront, mostly in new-age emerging businesses such as solar, EV charging, and others. Many of them are at a nascent stage but hold a lot of promise. In the current year, Tata Power intends to undertake capex of close to Rs 11000 crore. It spent Rs 4500 crore in the first half of the current fiscal. It has ambitious plans in renewable and clean energy which would start reflecting in its performance over the next two years.

Business Performance

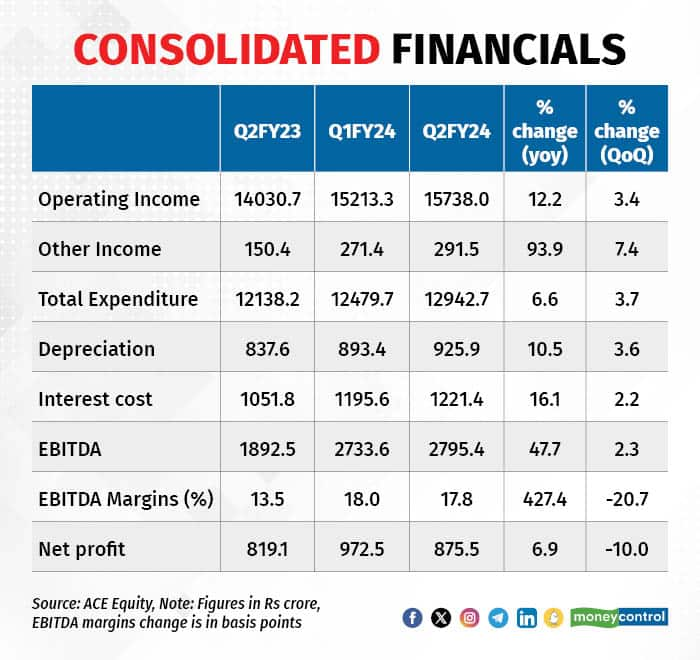

The company recently announced its results for the quarter ended September 2023, with the clean energy portfolio now amounting to 5500 MW or about 38 percent of its total capacity. During the quarter, its core standalone business reported a 4 percent year-on-year (YoY) growth in revenue.

However, excluding the standalone results, revenue from the remaining businesses, such as solar, renewables, and others, grew 18 percent on a YoY basis. Tata Power Solar Systems saw a 68 percent surge in revenues.

This also helped in higher profitability with EBITDA (earnings before interest, tax, depreciation, and amortisation) margins expanding by 427 basis points to 17.8 percent. The companys renewables business recorded an EBITDA of Rs 910 crore, a 33 percent YoY growth. While the traditional business is stable, new businesses have started to provide scale and margins which is a good sign for growth in the coming years.

Earnings Outlook

The company is aggressively expanding its clean energy portfolio. Close to 3760 MW is under implementation, which is expected to be operational over the next two years. Once these projects are operational, its renewable capacity will reach around 50 percent of the total operational capacity. By the end of 2030, it aims to reach 70 percent of its total capacity.

This does not include the 2800 MW pumped hydro power project which it expects to commission over the next 36 months.

One of its large projects — the single largest facility to manufacture 4300 MW solar cells and modules — has started trial production. This will start to contribute in the coming months and provide growth and earnings visibility. This facility would also ease supply-side issues and lighten cost pressure on its captive solar EPC projects. Its EV charger business is growing fast with 62000 home chargers and 4900 public chargers being installed.

Valuations

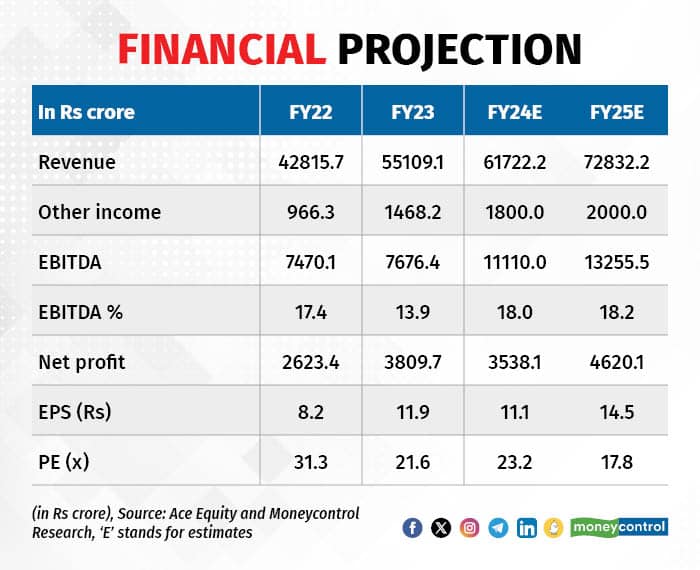

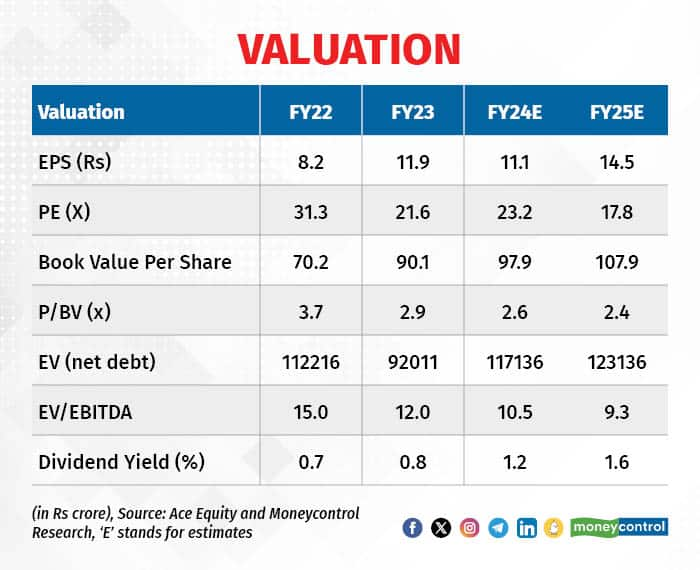

Post the results, the company has seen earnings upgrades mainly on account of higher margins and the contribution from renewables businesses. The

stock has experienced a modest correction from its peak of Rs 290 in April of this year to Rs 257 per share now.

It still offers good value in the light of sustained commitment to deploy growth capital in the emerging segments, emphasis on green energy, and initiatives to enhance conventional business operations.

Further, the potential turnaround of its traditional business is a key factor in the re-rating of the stock. Its present valuation stands at 18 times its anticipated earnings for the fiscal year 2025. This is reasonable.

Do write in your feedback and suggestions to: jitendra.gupta@nw18.com Follow author on X @jitendra1929.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now