Highlights

September 2023 quarter performance

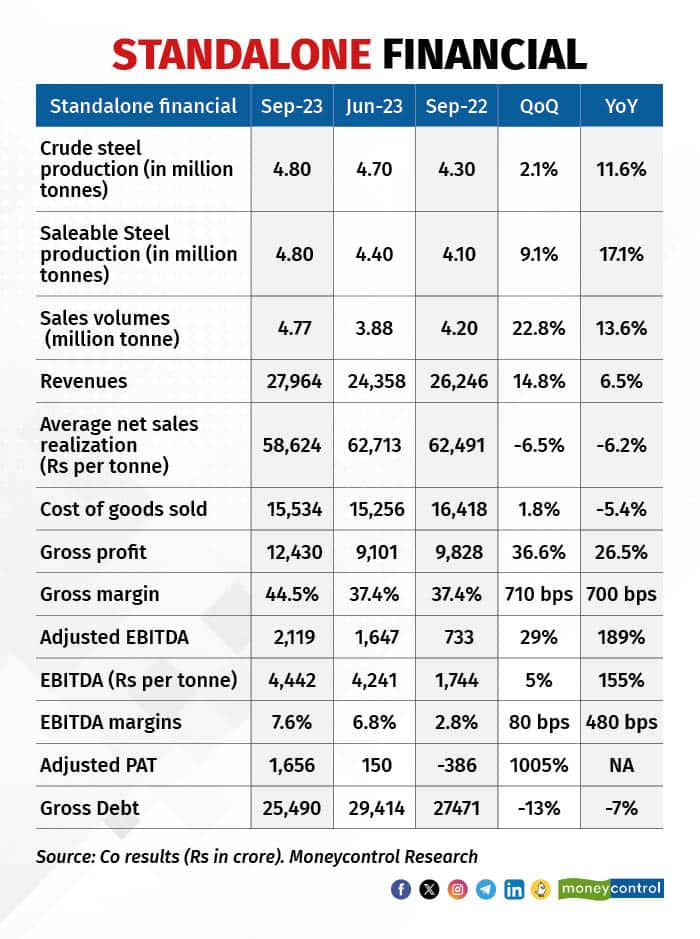

Though volumes remained strong, if the price revision from Railways amounting to Rs 1,750 crore for FY22 is removed, blended realisation was lower.

SAIL reported a deterioration in product mix and sold higher semis and lower flat steel. The cost decreased by 7 percent quarter on quarter (QoQ) on the back of lower coking coal prices. Adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) was higher, thanks to higher volumes, lower coking coal prices and operating leverage. The Street was expecting an EBITDA per tonne between Rs 5,500 and Rs 6,000.

Borrowings (non IND AS) declined both YoY and QoQ. Debt-equity ratio, as on September 30, 2023, stood at 0.5x, as compared to 0.6x, as on June 30, 2023. Book value, as on September 30, 2023, stood at Rs 129 per share, as compared to Rs 126 per share, as on March 31, 2023.

Outlook and valuation

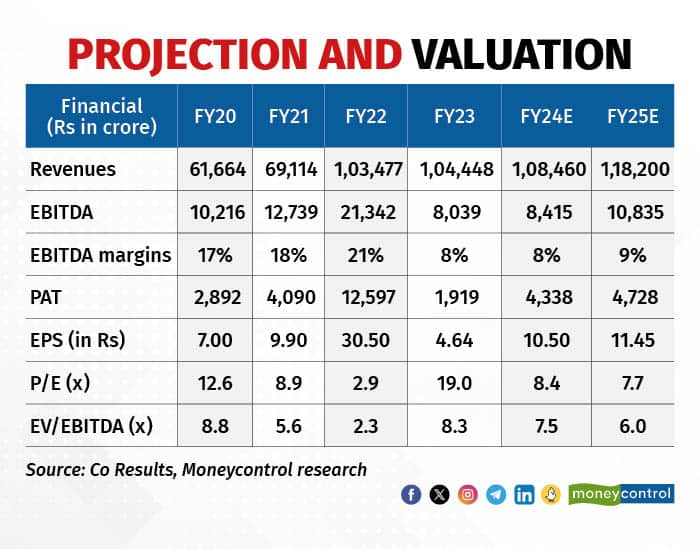

Volumes are likely to remain stable, given the infrastructure spending and higher demand from auto and other sectors.

Steel prices saw a price increase recently on the back of higher coking coal prices. Domestic flat and long prices have increased by 3 and 7 percent QoQ, respectively, from the end of the September 2023 quarter.

Spot coking coal prices are higher by $50 per tonne, compared to H1FY24. We expect EBITDA per tonne to remain stable for the December 2023 quarter as compared to the September 2023 quarter, as higher steel prices will be partly offset by higher coking coal prices.

Domestic steel prices are trading at a premium of around 5-7 percent to import parity, which is likely to keep steel prices under check. Higher coking coal prices are likely to impact the profitability of the March 2024 quarter, given that they remain at elevated levels. We might see higher EBITDA print as railway price revision from the previous years might get booked in the short to medium term. This will keep the Street excited.

The Chinese steel spread continues to remain under pressure due to lower Chinese steel prices and higher coking coal prices. Demand for steel is yet to recover in China as real estate and construction remained laggard and they remain net exporter, leading to depressed prices. Steel mills in China have reduced production and have witnessed a month-on-month decline for the last four consecutive months -- from July to October -- which will offer some support to the prices.

The SAIL management is evaluating various options to increase the steel- making facility by another 10 million tonnes through the brownfield and de-bottlenecking route in the medium term. This is likely to keep debt at elevated levels. The steel industry is expected to witness more than 15 million tonnes of additional capacity by March 2024, and that will put further pressure on realisation and profitability.

SAIL is trading at 0.7x trailing price-to-book ratio, compared to a 5-and 10-year median price-to-book of 0.6x. We remain neutral on SAIL and recommend investors to remain on the sidelines and wait for a better opportunity.

A key risk to our assumption is any divestment in SAIL by the government of India.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now