Highlights

With a higher planned capex in India's transmission and distribution sector, Power Grid (CMP: Rs207, Market capitalisation: Rs 1,92,894 Crore, Stock Rating: Overweight) is gearing up to grab a greater market share in the next couple of years.

For the current fiscal, the company has increased its capex guidance to Rs 10000 crore. For fiscal 2025, it has been pegged at Rs 15000 crore against about Rs 8800 crore earlier.

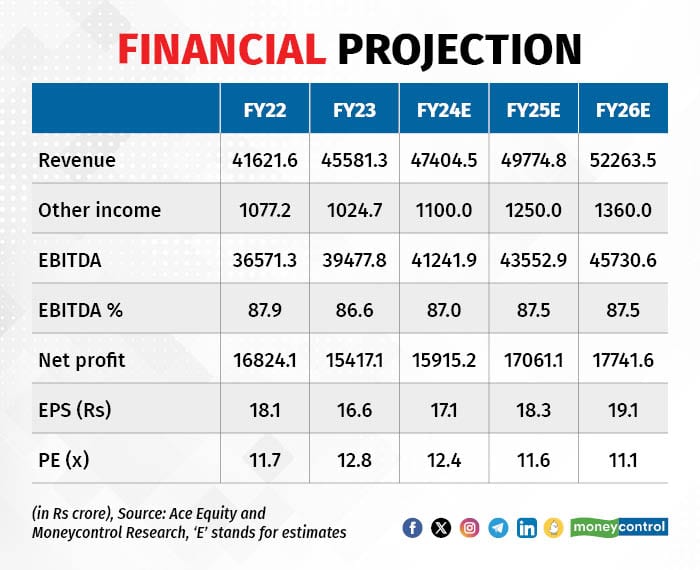

It is eying projects worth Rs 1.75 lakh crore to be awarded over the next 8 years. Its own annual growth capex is expected to increase to around Rs 20,000 crore annually, providing support to its growth and earnings visibility. The company is executing projects worth around Rs 50,500 crore; close to 70 percent of this pertains to the execution of renewable energy projects.

Results analysis

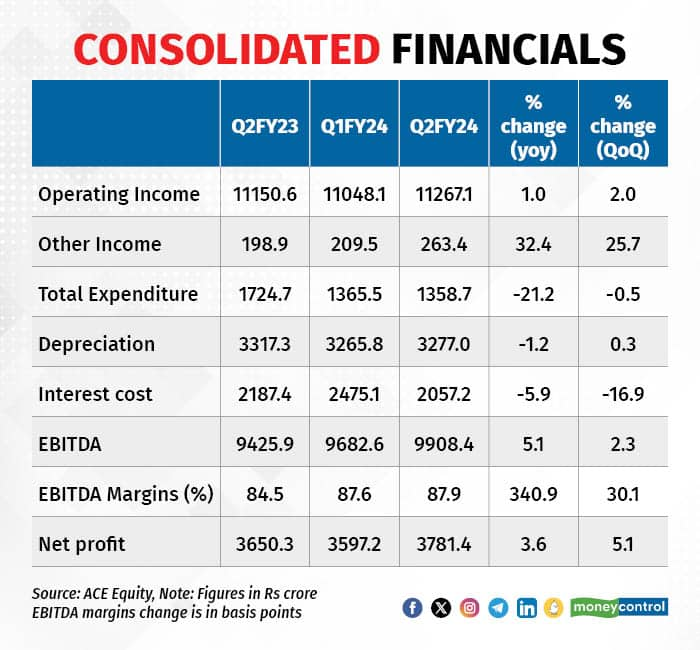

The company reported a 1 percent year-on-year (YoY) growth in revenues in the September quarter. Despite a 33 percent YoY growth in project capitalisation in the quarter ended September 2023, revenue growth was marginal because of lower transmission charges.

Despite this, operating profits grew 5 percent, led by lower expenses and higher efficiencies. But the finance cost increased 7 percent due to the increase in borrowing cost. However, this did not have much impact because of the 32 percent year-on-year growth in other income, thanks to greater incentives, dividends, and higher interest on deposits. The companys consolidated net profits grew 4 percent.

Valuations

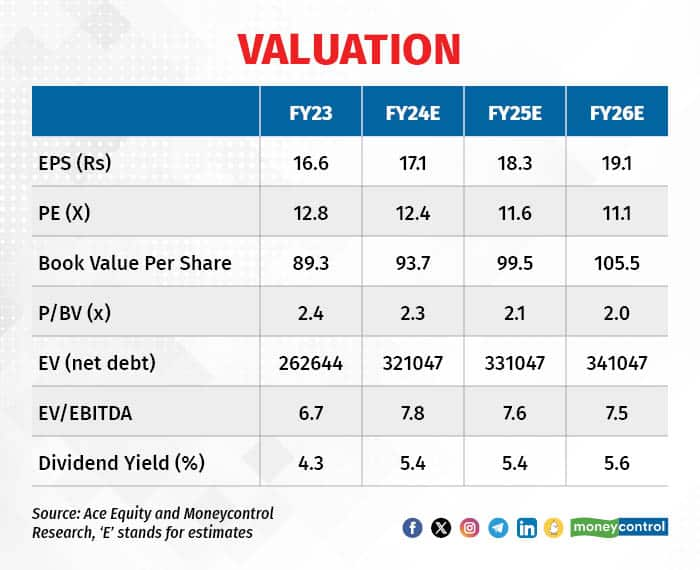

Power Grids stock continues to ride on the back of strong visibility, improving RoE (return on equity), and attractive dividend yield. The stock is now trading at 2 times its book value of fiscal 2026, which is reasonable and offers room for appreciation. At the current market price, it is offering a dividend yield of close to 5 percent.

Do write in your feedback and suggestions to: jitendra.gupta@nw18.com. Follow @jitendra1929

For more research articles, visit our Moneycontrol Research Page.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now