As one recent ruling of the Mumbai Tax Tribunal showed, failure to disclose your foreign assets (FA) in the ‘FA schedule’ of your income tax return (ITR) form can land you in trouble.

Upholding the order of the Commissioner of Income Tax (Appeals), the Mumbai Tax Tribunal, on August 9, 2023, imposed a hefty penalty of Rs 30 lakh on a taxpayer (Shobha Thawani case) under the Black Money Act for not disclosing a foreign financial asset in the FA schedule of her ITR form for three years.

This was despite the fact that the taxpayer had been disclosing the income from this asset in her tax returns.

“Even if income from a foreign asset has already been disclosed, non-reporting or misreporting (incorrect reporting) of the assets in the specifically provided FA schedule can lead to penalty, and even prosecution in fit cases under the Black Money Act,” says Preeti Sharma, Partner, Tax and Regulatory Services, BDO India.

Who has to report and what assets

Under the Income-Tax Act, an individual who is Resident and Ordinarily Resident (ROR) in India must report all his FAs and any foreign-sourced income in his IT returns.

Sonu Iyer, Tax Partner and People Advisory Services Leader, EY India, explains that an ROR must report his foreign assets in ITR-2 (if no business income) and in ITR-3 (if business income). “ITR-1 and ITR-4 are not prescribed return forms for foreign assets reporting,” adds Iyer. For more on who is an ROR, see graphic.

Offering more details, Sharma says that if you hold any FA, you must report them, irrespective of whether these assets are income-generating or not, or whether you have any taxable income in India in that financial year or not.

She points out that there is a misconception that only non-reporting of FAs can lead to penalties and prosecution under the Black Money Act (Black Money (Undisclosed Foreign Income and Assets and Imposition of Tax Act, 2015) but that is incorrect. Even misreporting of such assets can result in the same consequences.

So, what all FAs must you disclose in your tax returns? Almost everything, if we go by what is listed out in the FA schedule. “These assets are divided into 10 categories which are broad enough to cover all types of assets / investments and sources of income outside India,” says Sharma (see graphic). But she adds that it is not easy to identify the FAs to be reported based on a plain reading of FA schedule.

Be mindful of the details

In fact, tax experts we spoke with said one of the reasons taxpayers fail to disclose FAs in their tax returns is simply the lack of awareness on the need for FA reporting. “Most individuals are unaware that if they qualify as ROR of India and have held foreign assets during the financial year, they must report their foreign assets in ITR-2 or ITR-3,” says Iyer.

A very common miss is non-reporting of ESOPs (employee stock option plan) received by an employee from multinational companies, such as Amazon, Google, Microsoft, etc. Such ESOPs qualify as FAs and must be disclosed in your tax returns.

Then, another stumbling block for taxpayers, as Iyer points out, is that the data required to be filled in the FA schedule is very detailed. “For example, for a bank account outside India, you need to provide the following details – country name, name of the bank, address, bank account number, status (whether owner or beneficial owner or beneficiary), date of opening bank account, peak balance, closing balance and income earned during the year. It is difficult, at times, to collate historical data such as the date of opening, peak balance, closing balance etc., and hence, it is recommended that taxpayers maintain appropriate documentation,” says Iyer.

Sharma mentions that many foreign assets are required to be reported at their investment value and not their current value. “So, if someone had purchased a property 15 years ago, then finding the correct exchange rate (which is 15 years old) for conversion of the property value into INR terms will be a task for them.”

One also needs to be mindful of the financial year versus the calendar year in the context of FAs. Sharma lays out what needs to be done, very clearly. One, in the FA schedule, the taxpayer has to report the FAs held during the calendar year and the income generated from such assets in that calendar year. Two, in the tax return form, which has to be filed for the financial year, the taxpayer has to calculate the income from these FAs or any other foreign-sourced income during that financial year to arrive at the actual tax amount.

Also read: How to respond to an erroneous notice from the I-T Dept

Seek professional help

With innumerable complexities surrounding the reporting of FAs and foreign income, the chances of an individual taxpayer going wrong are high. And the consequences of non-reporting or even misreporting can be serious.

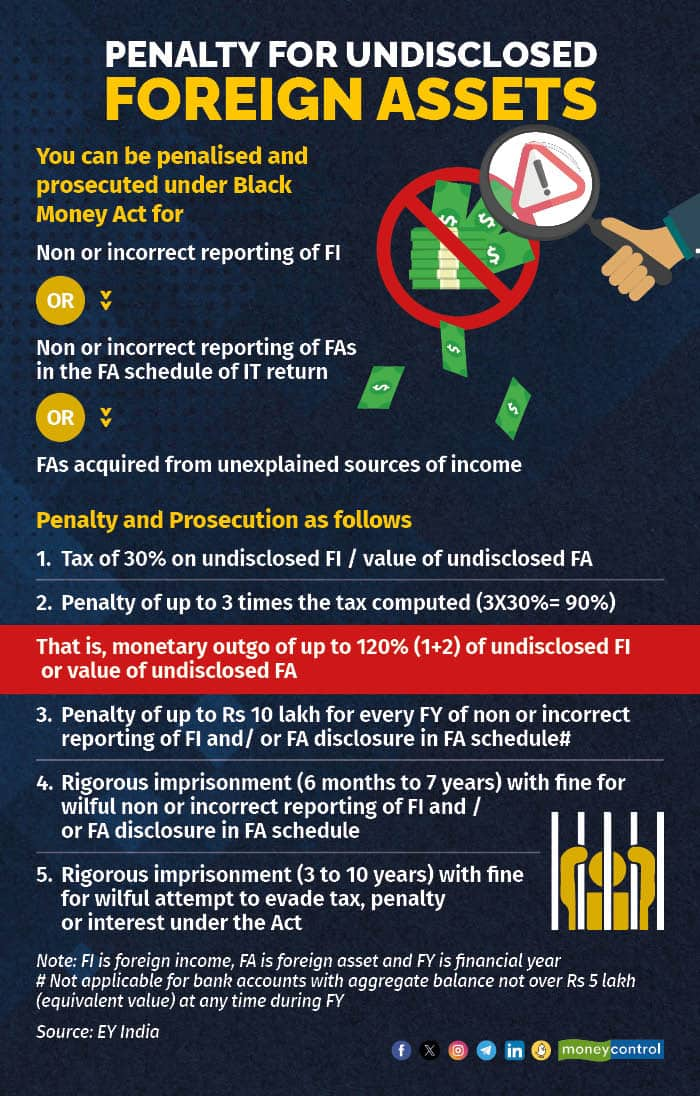

“Non-reporting or incorrect reporting of foreign income, or of foreign assets in the FA schedule, or where FAs have been acquired from unexplained sources of income, may lead to penalty and prosecution in addition to payment of taxes and interest. In such cases, generally provisions of the Black Money Act (which is more stringent) would take precedence over the Income Tax Act,” explains Iyer. (see graphic) Under this Act, not only do you face the risk of significant monetary penalty but also of imprisonment.

Many taxpayers like to take the DIY (do it yourself) route while filing their tax returns. But if you hold FAs or have reason to believe that you might, do seek professional advice. Given the tax department’s proactive approach to catching those not disclosing or incorrectly disclosing their FAs and foreign income, it is better to be safe than sorry.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now