Highlights

September 2023 quarter performance

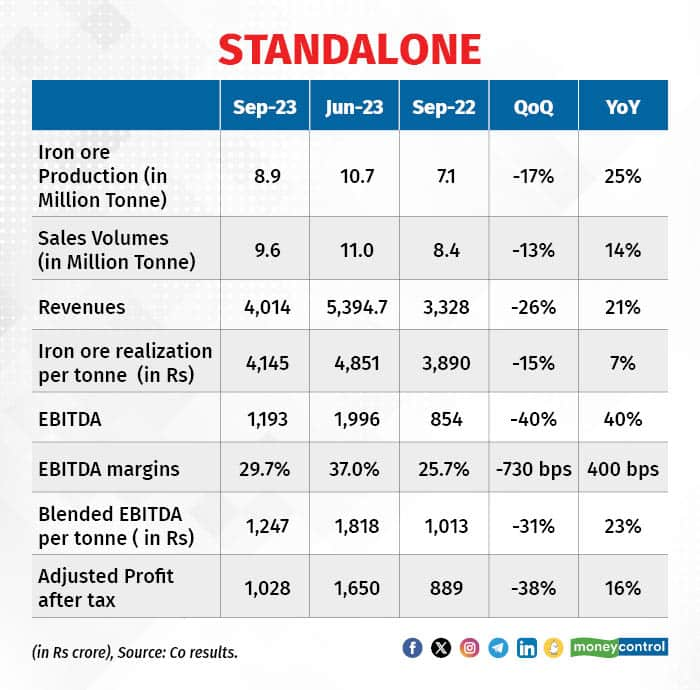

Revenues were lower quarter on quarter (QoQ) on the back of lower volumes as well as realisation and sales of lower value iron ore fines.

Average domestic iron ore prices were lower by 15 percent QoQ, at Rs 4,839, for the quarter that ended in September 2023. Average iron ore lump prices were down by 12 percent and iron ore fines prices were lower by 17 percent QoQ.

Earnings before interest, taxes, depreciation and amortisation (EBITDA) per tonne declined QoQ on the back of lower realisation, partly compensated by lower royalty.

Profit after tax (PAT) was lower due to lower EBITDA, higher depreciation and finance cost, which were partly offset by higher other income. Operating cash flows improved due to better working capital management. NMDC has cash and cash equivalent of Rs 11,734 crore (Rs 40 per share), as on September 30, 2023.

Other highlights

NMDC has spent Rs 1,000 crore for capex from April to September, compared to the Rs 1,600 crore expected for FY24. The capex target is likely to increase to Rs 1,800 crore for FY24. For FY25, NMDC is targeting a capex of Rs 2,200-2,300 crore.

The Bacheli mine screening plant, with a capacity of 2 million tonnes per annum (MTPA) should be on stream within the next 4-5 days and NMDC expects production volumes of around 1-1.5 MT from the same in H2FY24.

The environmental clearance for the Kumaraswamy mines for 3 MT is expected in the next 7-10 days. This will add around 2.3 MT of additional capacity for NMDC.

Gold mining has started in Australia and the management expects to reach 1 MT in 12-15 months.

Outlook and valuations

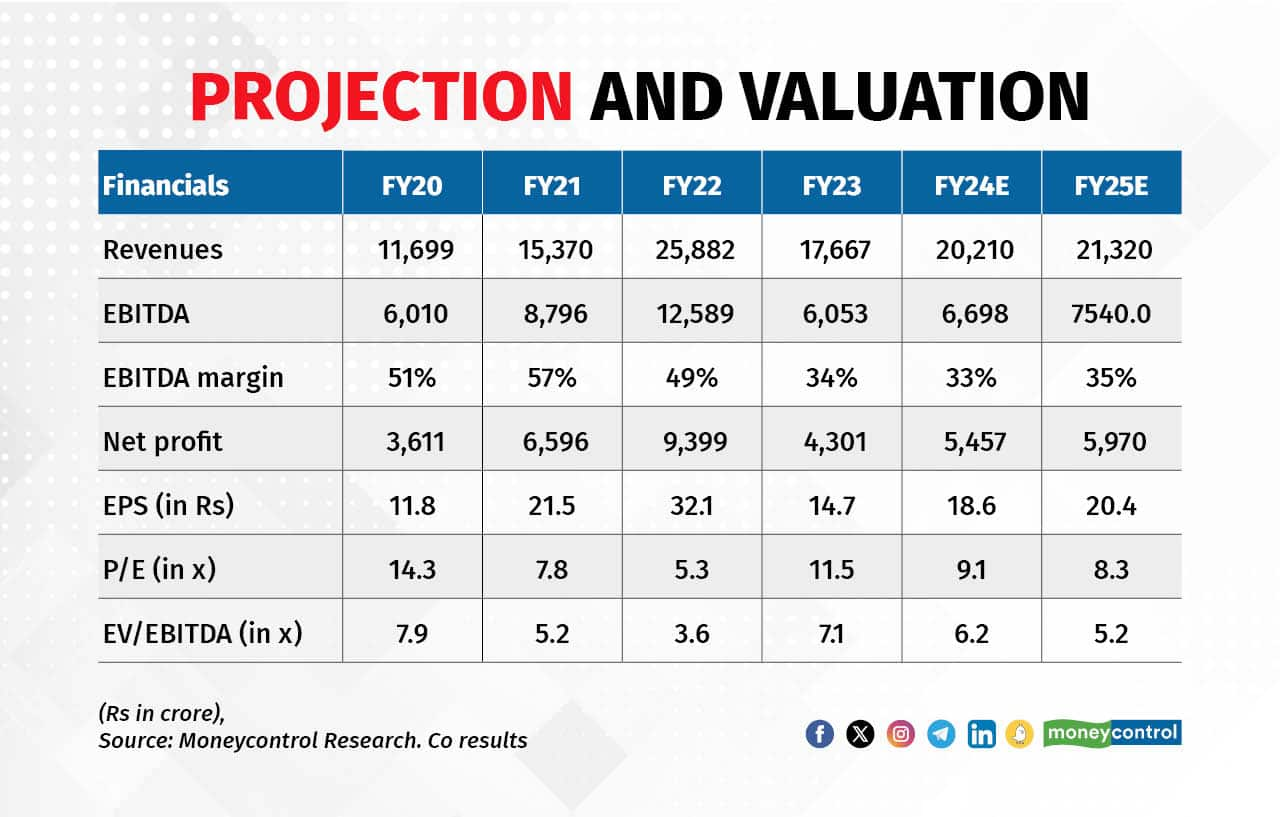

NMDC has guided for the production and sales volumes of 47-49 MT for FY24, as compared to the production and sales volumes of 23.5 MT and 24 MT from April to October 2023, respectively.

For FY25, NMDC is targeting 51-52 MT of production and sales volumes. Bacheli and Kumaraswamy mines will help in incremental volumes. NMDC has increased the prices of iron ore lumps and fines in September and October by a cumulative 11-13 percent.

With higher international prices, we expect another hike in November, though the management has not guided for the same. NMDC’s iron ore fine prices are trading at a discount of nearly 20-22 percent to export parity prices, which leave headroom to increase prices.

India is likely to witness an incremental steel-making capacity of more than 15- 20 MT by the end of FY24 from players like JSW Steel, Jindal Steel and Power and others. International iron ore prices are currently higher on the back of higher Chinese production.

NMDC is targeting 10-15 percent of the top line from other businesses (other than iron ore), once all the diversified projects are completed. Diversified projects include gold and diamond mining.

We have increased our projection for realisation and EBITDA per tonne for the rest of FY24 and FY25. Higher visibility on volumes, along with cost-saving projects, will aid earnings growth. A debt-free balance sheet and lower capex, compared to the free cash flows, should support higher dividend or buyback from NMDC, supporting valuation. We remain positive on NMDC and recommend high-risk investors to add and accumulate the stock on declines.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now