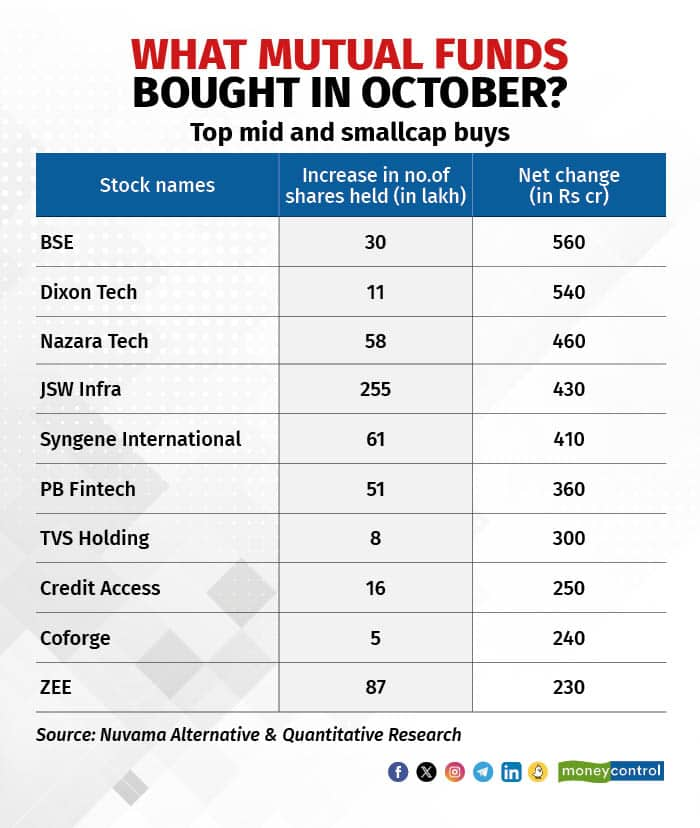

BSE, Dixon Technologies and Nazara Technologies were among the most bought mid- and smallcap stocks by domestic mutual funds in October. Mutual funds added 30 lakh shares of BSE, 11 lakh of Dixon Tech and 58 lakh shares of Nazara Tech during the month, data compiled by Nuvama Alternative & Quantitative Research shows.

The BSE stock has gained over 300 percent in the past six months, with analysts predicting more gains on expectations of its expanding derivatives business. The Mumbai-based stock exchange relaunched derivative contracts on the benchmark Sensex and Bankex in May, which is attracting investors with reduced lot sizes and a new expiry cycle.

Fund managers' optimism for Dixon Technologies stems from large client wins like Xiaomi in the mobilephone segment. While growth in the mobile division would dilute margins, it would lift the company’s top line to Rs 33,000 crore-plus by FY26E, analysts said.

Check Moneycontrol's special compilation for investment ideas and stock picks for the new year

Meanwhile, Nazara Tech has clarified that the recent government decision to levy a 28 percent GST appplied only to the skill-based real-money gaming segment of its business, which contributed 5.2 percent to its topline in FY23.

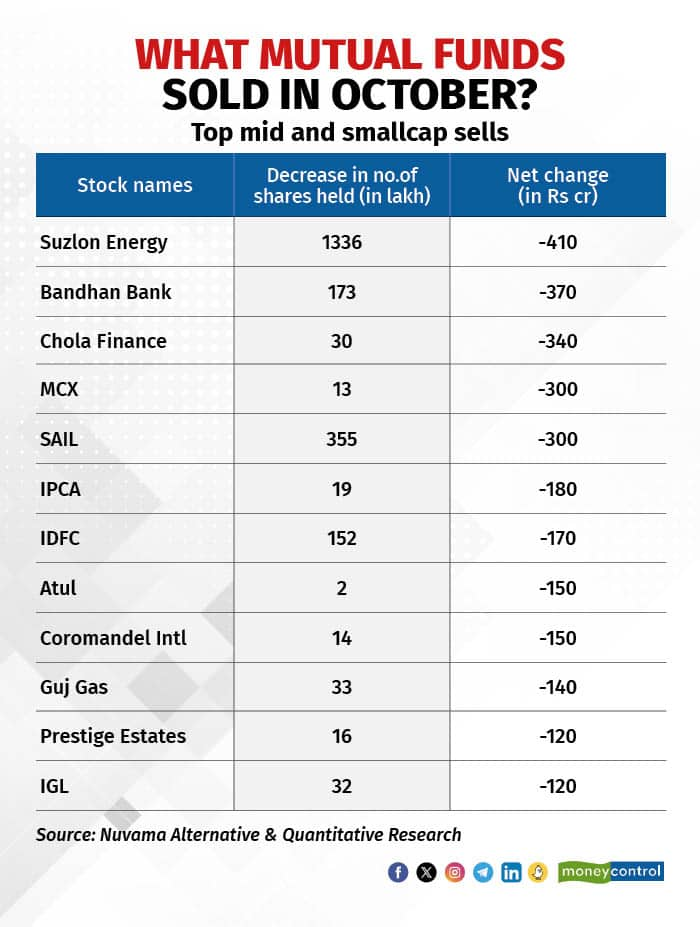

What did MFs sell?

Suzlon Energy (13.3 crore shares), Cholamandalam Finance (30 lakh shares) and Indraprastha Gas (32 lakh shares) are some prominent names that mutual founds sold from broader markets, Nuvama Institutional Equities said.

Investor sentiment towards Suzlon Energy turned a bit sour after Sun Pharma promoter Dilip Shanghvi and Associates in September decided to terminate the amended and restated shareholders' agreement with the company. The stock, however, got back its mojo in a few days and has gained 45 percent over the month. In the past six months, the stock is up 370 percent.

On the other hand, Cholamandalam Finance's margins are under pressure and the NBFC is seeing higher delinquencies in new business segments. For Indraprastha Gas, the Street fears that sales volumes will be affected as the Delhi government's new electric vehicle (EV) policy wants all cab aggregators to run 100 percent electric fleets within five years.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!