The real estate sector, in particular, has witnessed notable transformations in the last decade, marked by the implementation of RERA and GST, which have cleansed the industry, retaining only dedicated developers and significantly improved the regulatory environment.

The emphasis on affordable housing is aimed at addressing the housing needs of the bottom of the pyramid. Demonetisation and measures against cash usage played a crucial role in controlling abnormal price escalation.

However, property prices remain exorbitant, especially in metropolitan areas, posing a persistent challenge to affordability for many. Despite a few positive changes, accessibility to housing is limited, with rental housing developments still lagging behind and remaining on the distant horizon.

Five Hits

Affordable housing push:

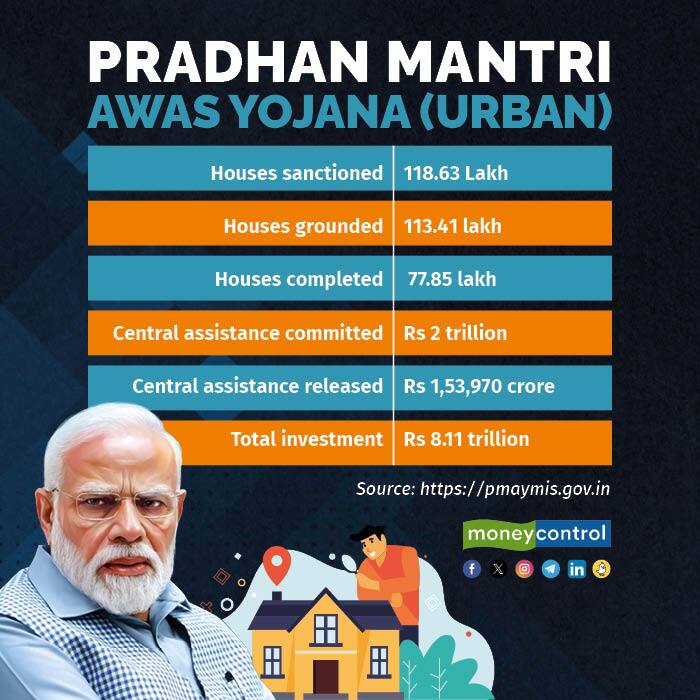

The government's focus on promoting affordable housing through schemes such as Pradhan Mantri Awas Yojana (PMAY) and the credit linked subsidy scheme in 2015 has been a notable development. This initiative aimed to address the needs of the low and mid-cost housing and boost overall demand in the real estate sector.

Implementation of RERA (Real Estate Regulation and Development Act) 2016:

The introduction of RERA in 2016 marked a significant hit for the real estate sector in India. This regulatory framework aimed to enhance transparency, protect the interests of homebuyers, and bring accountability to developers. It mandated developers to register their projects, adhere to project timelines, and maintain a higher level of financial discipline.

The Insolvency and Bankruptcy Code (IBC) and amendment recognising homebuyers as financial creditors:

The introduction of the Insolvency and Bankruptcy Code (IBC) in 2016 and the subsequent amendment in 2018 recognising homebuyers as financial creditors significantly transformed the Indian real estate landscape. Empowering homebuyers with the status of financial creditors elevated their position in insolvency proceedings, enabling them to actively participate in decisions affecting project outcomes.

Also read | Explained: Key Fact Statement of a loan and why it is important

Demonetisation and digital push:

The real estate sector felt the significant repercussions of the government's 2016 demonetisation initiative. By abruptly withdrawing high-denomination currency notes, the goal was to combat black money and corruption. This measure considerably curtailed the prevalent use of cash in real estate transactions, dissuading investors from injecting unaccounted funds into the sector. As a result, the move acted as a check on price hikes within the real estate market.

Goods and Services Tax (GST) implementation:

The implementation of GST in 2017 streamlined taxation in the real estate sector, replacing multiple indirect taxes. While it initially caused disruptions, the move aimed to create a unified tax structure, eliminating cascading taxes and promoting a more organised and transparent system.

Five Misses

Delayed implementation of RERA:

The slow and staggered implementation of the RERA in various states created inconsistencies, delaying the expected positive impact on the real estate sector. This lack of uniformity diminished the effectiveness of the regulatory framework in providing timely relief to homebuyers.

Also read | RBI’s tightening loan norms will not impact borrowers in near-term

Unresolved project delays and defaults:

Project delays and defaults by developers remained a persistent challenge. Despite regulatory measures, several projects faced delays, leaving homebuyers in limbo and eroding trust in the sector. The lack of a robust mechanism to swiftly address and resolve such issues remained a significant drawback.

Lacklustre approach towards rental housing:

Despite advancements in India's real estate sector, rental housing development has lagged significantly. The absence of targeted policies and incentives has resulted in no advancement in this segment. This failure to address the rental housing sector's needs has left many individuals without viable and affordable housing options.

Also read | Planning to buy a home this festive season? Here are six things to consider

Not granting industrial status:

The absence of industry status for real estate in India has proven detrimental to the sector's growth. Without this recognition, developers face challenges in accessing institutional funding and tax benefits. Limited financial support hampers large-scale projects, hindering the industry's potential contributions to economic development and exacerbating affordability issues for both developers and homebuyers.

Rationalisation of overhead expenses like GST, Stamp Duty and registration fee:

Despite the reduction in GST, additional charges such as stamp duty, registration fees, transfer fees, and other legal expenses contribute to a substantial increase of up to 20 percent in the overall cost of property acquisition for homebuyers. Persistent calls for the removal of GST or a rationalisation of stamp duty to alleviate these expenses have been made, but substantive changes have yet to materialise.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!