When it comes to credit cards, the Indian customer is spoilt for choice. Whether you are a first-time user or a frequent flyer, there is something for everyone with over 50 different types of cards available to choose from.

However, does having the variety to choose from make owning multiple credit cards an efficient choice?

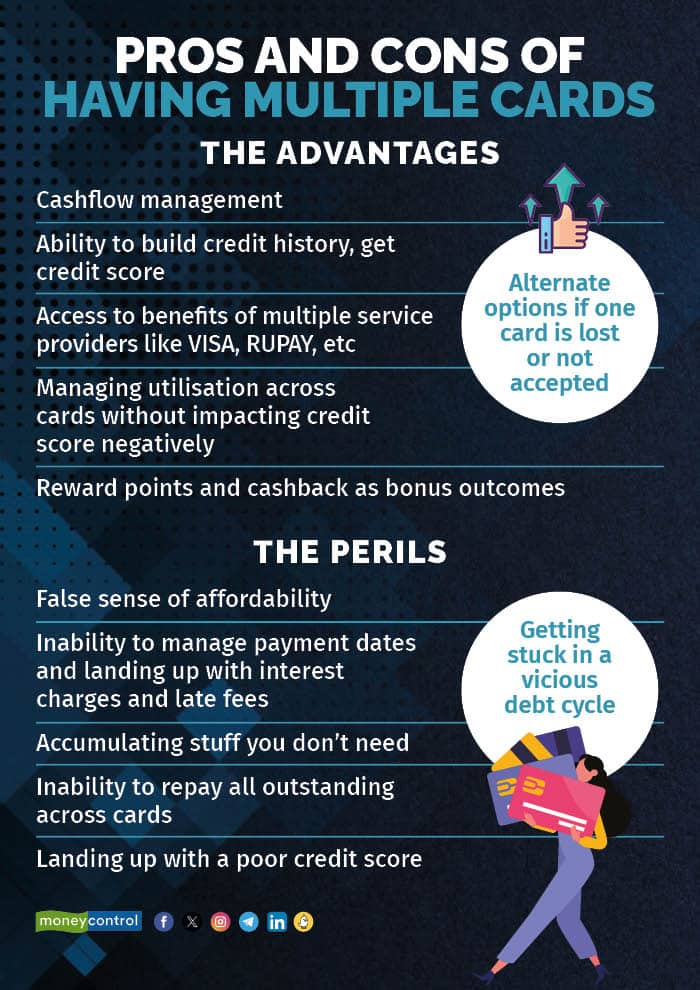

How many credit cards are too many? Clearly, there is no formula for this and each individual is likely to have access to different cards or even choose different cards. While an ideal number can’t be pinpointed, you can weigh the pros and cons of owning too many credit cards and then decide how many you can manage.

Also read: The right way to get the first credit card and build a credit history

What are the benefits of having multiple cards?

Cash management – credit cards, if used with discipline, are a great tool for cash flow management. Discipline means the ability to keep your credit card spends much below the available overall limit and to repay on time every time. If the latter does not happen you end up paying interest charges and late fees.

In order to enforce this discipline, you need to know your credit card billing cycle; with multiple cards, you can have complementary billing cycles, such that when one card reaches the last day of its credit period, you can rely on the next available benefit of another 50-day credit cycle.

According to Khyati Mashru Vasani, Founder, Plantrich Consultancy LLP, “Carrying multiple credit cards can act as a backup in case one card is lost, stolen or declined. It’s also convenient to have an alternate card if a particular card is not accepted in some merchant outlets.”

Reward points and cashback - credit cards come with bonus gifts for frequent users. These could be in the form of reward points; general or specific and even cashback offers. There are specific travel points linked credit cards, which favour the conversion of points to airline miles or shopping related cards which give cashback offers on both online and offline shopping with specific brands and stores and so on.

Moreover, the cards may be issued by different service providers like VISA, Mastercard or Rupay, which, come with their own benefits around offers, international spends and so on.

Establishing a good credit score – Credit scores are a way for banks to evaluate the creditworthiness of individual borrowers. A high score is an advantage as it suggests a good history of repaying loans of various types.

“People who don’t have a credit history or are new to credit can get a secured credit card. It works like a regular credit card but is secured against a fixed deposit with the issuing bank. This helps in building one’s credit history and credit score, which then makes one eligible for credit cards and other types of loans,” says Parijat Garg, a personal finance expert.

Thus, using one credit card, maintaining a rational level of usage and repaying on time helps to get a good score. At the same time, if you are able to manage more than one card suitably, it can be very useful in showing that you have good cash flow management and creditworthiness. “A credit score considers aggregate utilisation of credit limits if one is using more than one card. It’s possible to keep overall utilisation low even if you spend more on one card thanks to the higher collective limit.” Garg added.

There are several benefits that you can derive from having more than one card, but these can easily backfire.

Also read: The charges lurking in your credit card you didn’t know about

How having multiple cards can land you in trouble

False sense of affordability - Too much credit is a dangerous slope. If you lack discipline, you can very easily find yourself in a situation where you are maximising your limit on each card. While in the beginning you are able to repay with your savings, slowly, the pattern of overspending can become a habit which is difficult to change and you’ll find yourself falling behind on repayment, landing yourself in debt.

While swiping your card, there is no immediate impact on your cash flows, your bank account is unaffected and you get instant gratification. It’s easy to fall into a debt trap. Not only does such a situation have the potential to cause you stress, but also in the practical world, it will spoil that credit score we spoke about.

Inability to manage repayment dates – You may not be overspending on your cards, but having too many may lead to confusion on due dates and billing cycles. If you are the unorganised kind of spender, you may very well end up overspending on the card where a new credit cycle has started but you have forgotten to clear the previous dues. At the same time, you may have cleared dues on a card which isn’t even close to its last date on the billing cycle.

Having multiple credit cards comes with a high level of financial responsibility and discipline.

“Each credit card will most likely have been issued at a multiple (2-3 times) of one’s salary, thus giving you a higher ability to spend. A higher limit is more convenient as the customer is expected to repay in full on the due date even when one has spent beyond one’s monthly salary. Banks charge high interest and late payment fees if there are delays in card outstanding repayment; with multiple cards, this becomes furthermore challenging to manage,” says Garg.

You may end up paying too many late fees and charges for this to be a worthwhile experience.

Collecting stuff you don’t need – First, you spend on the card itself and then you use the reward points to get more stuff. Having the ability to buy things without having to show cash for it may lead to accumulating things that you don’t really need.

This kind of material overcrowding of your space feels good for some time, but if not managed well can lead to a constant feeling of inadequacy till your next purchase. Subsequent buying may easily become frivolous and wasteful, taking you away from the values that really matter with only one aspect of material comfort coming into focus.

According to Vasani, “One strategy could be having 2-3 different cards to optimise benefits and rewards for specific categories like one for availing fuel concessions, one for catering to indulgences and say one for travel discounts. This can also help you track spending in each category separately, making budgeting and financial management more convenient.”

You may think that having multiple cards lets you spend better, especially if they have a low spending limit. However, keep in mind that a credit card outstanding is a loan, it means you are borrowing to fund your spends and you must repay on time. Having multiple cards does not improve your ability to afford more. Moreover, many cards come with an annual fee too.

“Ideally, deal with as many cards as you can mindfully. This means not buying useless things just because you can and avoiding late payments on the amounts due,” says financial planner Deepali Sen, founder partner, Srujan Financial Services LLP.

The answer to the question – how many are too many – lies with you. While some can manage even 4-5 cards with great discipline and organisation, others find it hard to spend within the credit limit offered on just one card. Get your own unique number for how many credit cards you need to have but keep in mind all the pros and cons before arriving at this number.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now