Highlights

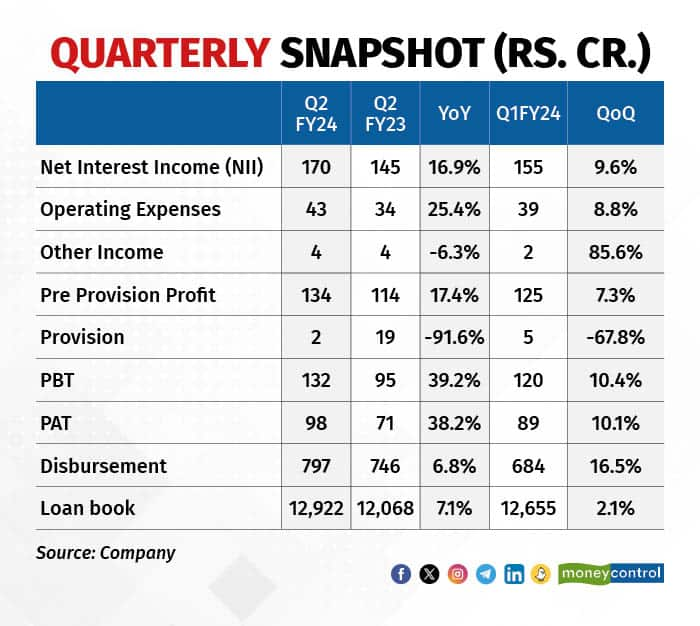

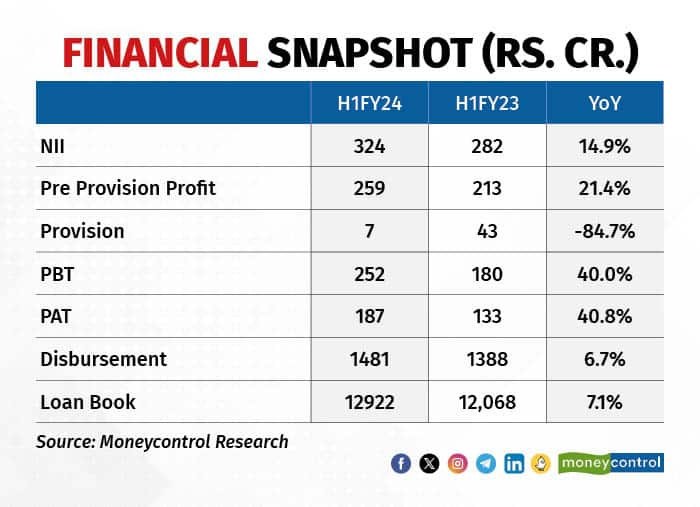

The September quarter (Q2 FY24) saw improvements in earnings and asset quality, aiding return ratios. Net profit grew 38 percent year on year (YoY) to Rs 98 crore, driven by better yields and lower provisions.

Post the rollout of the Phase I of the new IT platform, disbursals and profitability are growing consistently and higher growth is expected in the second half of the current fiscal (H2 FY24).

Q2 FY24 Update:

Moderate loan growth, but outlook encouraging

The process improvements are underway (phase II went live in Q2), with visible green shoots of growth in a seasonally weak September quarter.

The company registered a sharp sequential growth in disbursement of 17 percent QoQ, surpassing the earlier guidance of 9 percent. This aided a moderate rise in the loan book, which stood at Rs 12,922 crore in September.

Balance transfers were under control, backed by improved customer servicing and competitive pricing.

The festive season will drive growth in H2 FY24. Consequently, the management increased the disbursement growth guidance to 30 percent YoY in FY24 (earlier 20 percent), while the long-term loan book growth target remains at 12 percent.

Source: Company

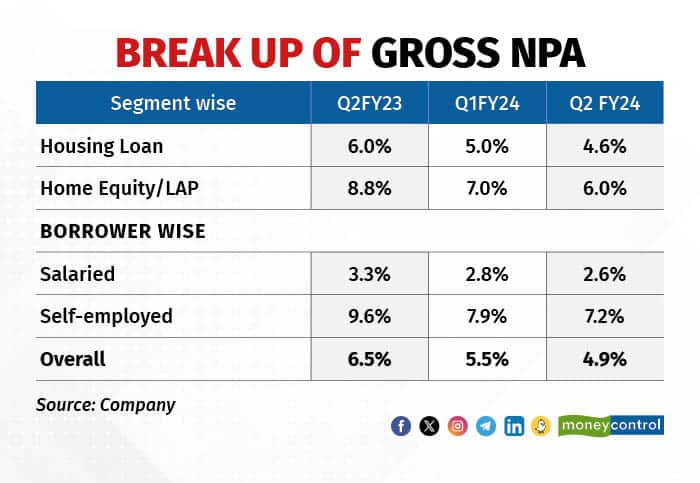

Improved GNPA ratio across asset class and customer mix

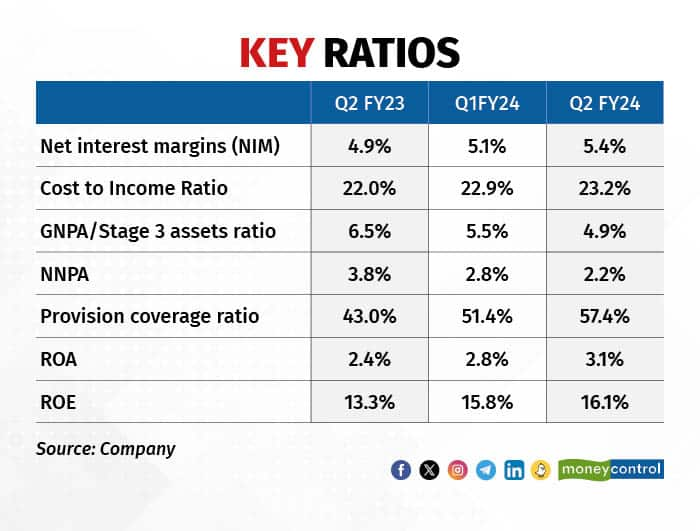

The gross non-performing asset (GNPA) ratio improved by 60 basis points QoQ to 4.9 percent in Q2. Repco is strengthening its collection team to focus on Stage 2 assets (loans overdue by 31-89 days).

The management targets to bring down the Stage 2 ratio to single digit by 2025, on a par with the market, which is now high at 10 percent due to the legacy book.

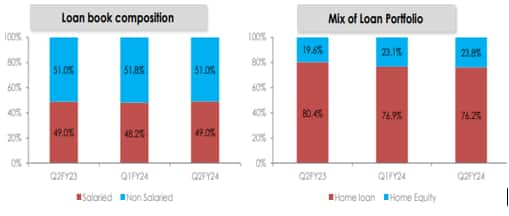

Given the high share of self-employed customer mix, contributing 51 percent of the loan book, the provision coverage ratio (PCR) of 57.4 percent is comfortable.

The PCR increased by 600 bps QoQ in Q2 and will remain at similar levels in FY24.

Core profitability strong, margins improved

Despite higher opex, the pre-provision profit increased 7 percent QoQ, driven by a higher portfolio yield. The company is repricing the book every three months, which is helping to improve profitability.

The operating expense (opex) remains high, led by tech-transformation and branch expansion. The total budget for tech-transformation is estimated in the range of Rs 40- 50 crore and the cost-to-income ratio is guided to remain at around 23 percent in FY24.

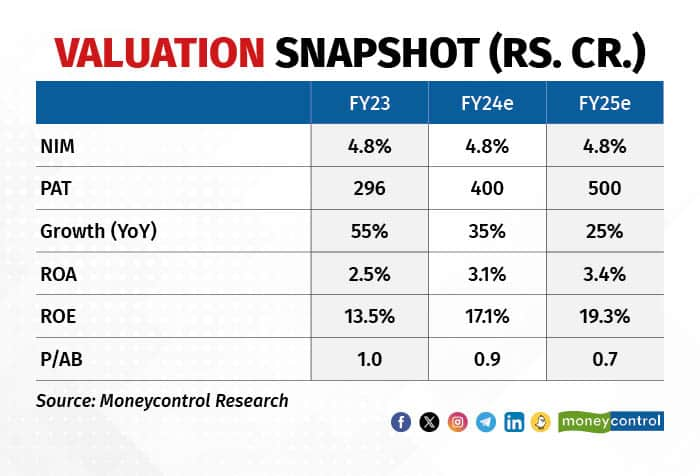

Net interest margins remain high at 5.4 percent (up 30 bps QoQ) and is guided to stabilise around 4.7-4.8 percent in FY24.

Outlook

Repco Home is on track to profitability and on asset quality growth parameters. It is now striving to take the growth number to the next level.

Sales verticals are helping in gaining new businesses. The new-book performance is good with a better customer mix on account of a more rigorous selection process post the roll-out of the Phase I.

Individual home loan (HL) growth is slower than the growth in loan against property. However, the management expects an improvement in the HL growth rate as good quality customers get added.

Repco plans to open new centres in Andhra, Karnataka, and Gujarat, with core operations in Tamil Nadu (57 percent of loan book).

The company is yet to avail the NHB funding, post which the overall borrowing cost will decline and the long-term spread will be maintained at 3.5 percent.

Attractive valuation

Repco trades at 0.7 times its FY25e P/BV. With return ratios remaining attractive, Repco deserves a higher valuation, which indicates room for a strong upside. The return on equity (RoE) crossed 16 percent in Q2.

With the risk-reward ratio extremely favourable, investors should buy the stock.

For more research articles, visit our Moneycontrol Research page

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now