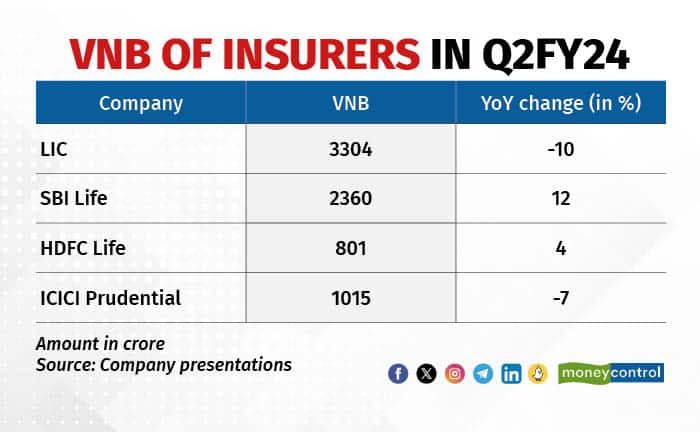

Insurance companies saw pressure on their value of new business (VNB) in the July-September quarter on account of tough competition and a change in the product mix of insurers, a Moneycontrol analysis of the top five insurers showed. VNB is an important indicator that measures the profit margin of new business written by a life insurance company. In the July-September quarter of the current financial year, VNB dipped for most insurers whereas some reported single-digit growth.

To give an example, the country’s largest insurer, the Life Insurance Corporation of India (LIC), saw its VNB drop by 10 percent. The VNB for the insurer stood at Rs 3,304 crore. In the case of ICICI Prudential, the second largest in the country, the VNB dropped by 7 percent over the previous year to Rs 1,015 crore.

On the other hand, SBI Life’s VNB jumped by 23 percent to Rs 2,360 crore and HDFC Life’s VNB stood at Rs 801 crore, growing by 4 percent.

What went wrong?

In the post-results press conference, Siddhartha Mohanty, the LIC chairperson, said the insurer worked on realigning some of its products due to which VNB margins were affected. Additionally, Dinesh Pant, executive director, LIC, said that a crowded field and changes in rates affected the margin too.

Also read: LIC Q2 Results: Net profit at Rs 7925 cr, net premium income falls to Rs 1.07 lakh crore

"There is competition and change in our product mix and revision rates which has affected our VNB margins," Pant said.

Avinash Singh, senior research analyst, Emkay Global Financial Services, said that the pressure on VNB was on expected lines as companies were focusing more on growth and investing.

““Higher share of ULIP in the product mix this year, in the backdrop of taxation changes related to above Rs 5L non-linked policies, also put pressure on margins. Insurers saw VNB pressure in Q2FY24 because a lot of companies worked on new products,” Singh said.

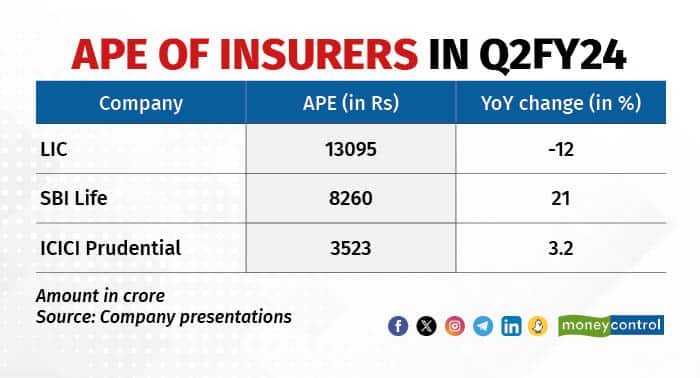

The total annual premium equivalent (APE) is a metric used to measure new business sales growth.

In the July-September FY24 quarter, insurers saw a mixed development in their APE. LIC’s APE stood at Rs 13,095 crore, a drop of 12 percent. For SBI Life, the APE for the quarter stood at Rs 8260 crore, a growth of 21 percent. ICICI Prudential’s APE grew a marginal 3.2 percent to Rs 3523 crore.

Suresh Badami, deputy managing director, HDFC Life, said in the analyst call after the Q2FY24 results that the company has seen significant growth in tier 2 and 3 markets.

“There are certain features which are more favourable in tier 2 and tier 3 markets, and we will continue to innovate on that,” Badami said.

Profit trends

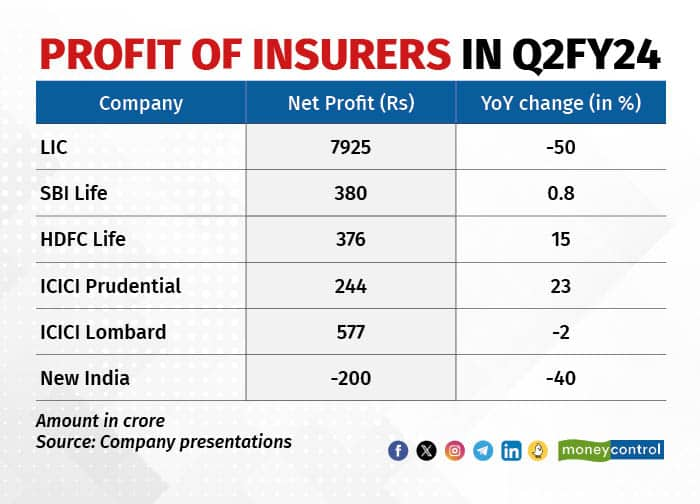

The average net profit of insurers, which include both life and non-life companies, showed a mixed trend in the second quarter, the analysis showed, even as the total APE), which is a metric used to measure new business sales growth, saw an aggregate of single-digit growth.

LIC reported a 50 percent drop in profit to Rs 7,925 crore. The corresponding figure for New India Assurance saw a 40 percent drop, falling into a loss of Rs 200 crore from a profit in the same quarter the previous year. ICICI Lombard’s profit fell by 2 percent and stood at Rs 577 crore.

SBI Life, HDFC Life and ICICI Prudential reported a growth in their net profit with SBI Life’s profit up 1 percent at Rs 380, HDFC Life’s net profit stood rising 15 percent to Rs 376 crore and ICICI Prudential’s net profit jumping 23 percent to Rs 244 crore in the July-September FY24 quarter.

Neerja Kapur, CMD, New India Assurance, said that in Q2FY24, the company saw a one-time loss due to floods. “Q2FY24 was one of the most challenging quarters for the company in recent times. The company suffered CAT (catastrophe bond) losses on account of floods amounting to Rs 301 crore during the quarter. Also, there was adverse development in the aviation portfolio of about 50 crore,” Kapur said.

Also read: HDFC Life Insurance bets big on partnerships in tier 2 and 3 cities, says CFO

Singh of Emkay highlighted that movement of bond yield also affected insurers.

“Growth in private insurers is holding despite development in the taxation, whereas bond yield movement also affected the overall growth of the companies,” Singh said.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!