Highlights

Q2 FY24– focus back on profitability

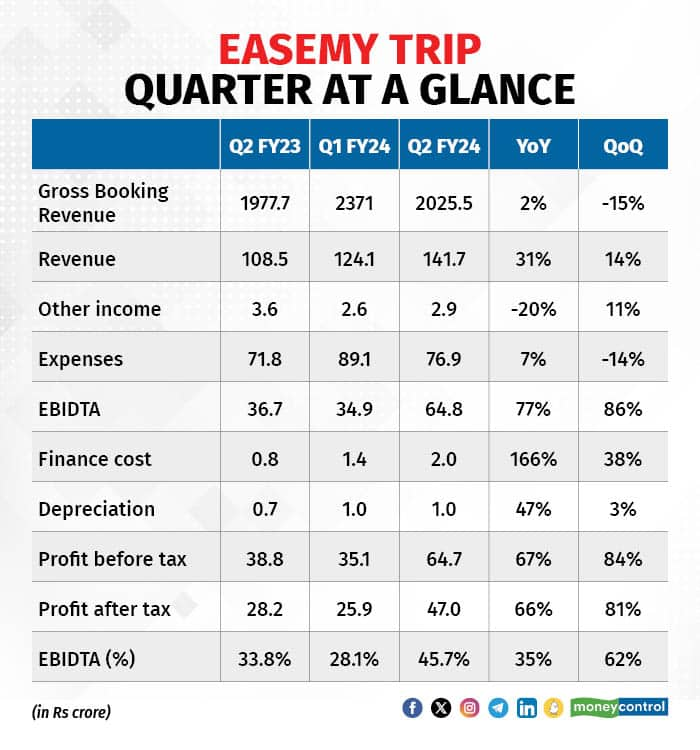

The Q2 FY24 quarter saw a sharp rebound in profitability, thanks to the spike in realised revenue and adept cost management.

Source: Company

Source: Company

The strategic shift

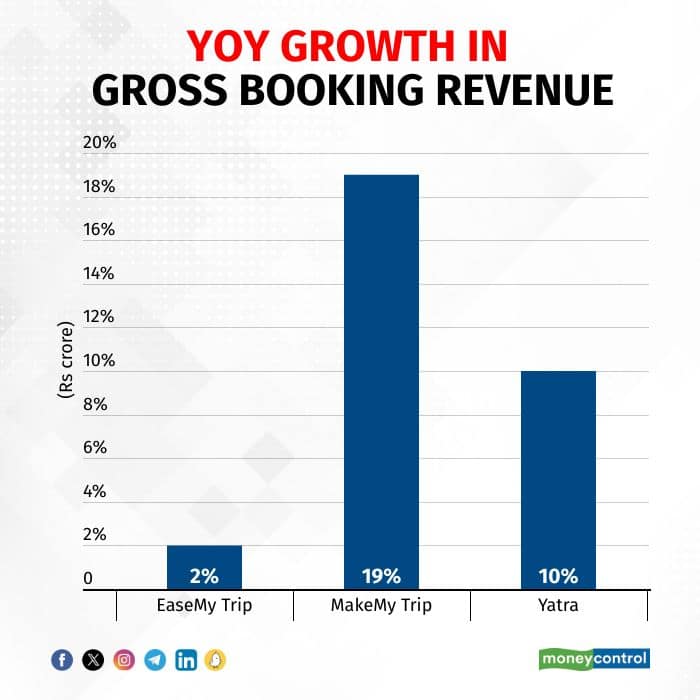

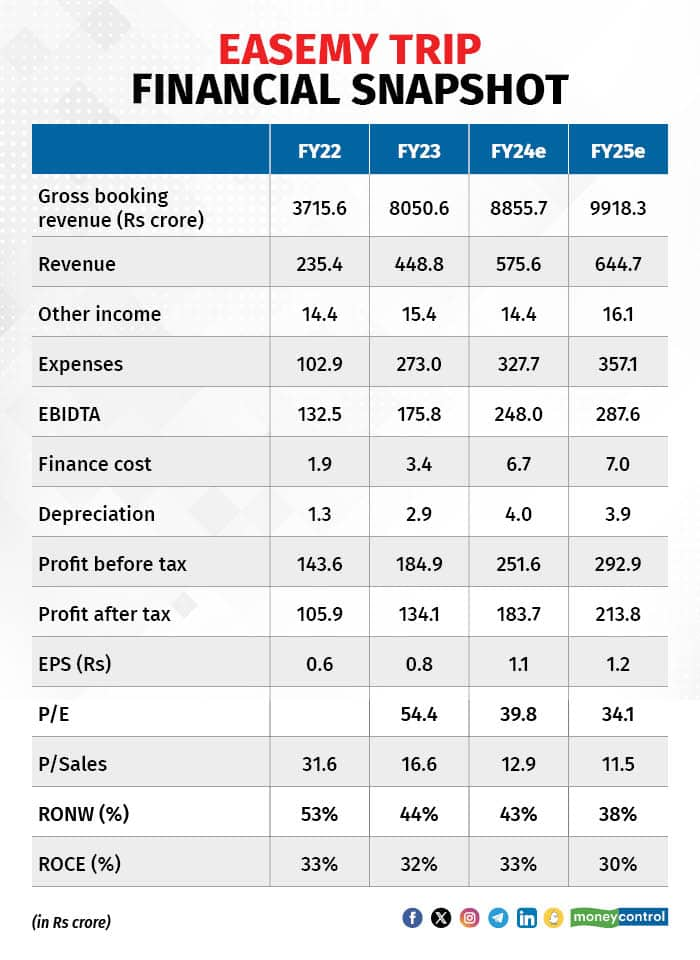

This quarter’s earnings report was all about the change in strategy. The hunger for growth and capturing market share, underpinned by the rapid increase in gross booking revenue (GBR) at the cost of higher marketing and sales promotion expenses, was substituted by a sharp focus on profitability.

Consequently, EMT saw a tepid increase in GBR year on year (YoY). While focus on profitability is welcome, we need to see if it means loss of market share which could impede future growth and profitability.

Source: Company

Source: Company

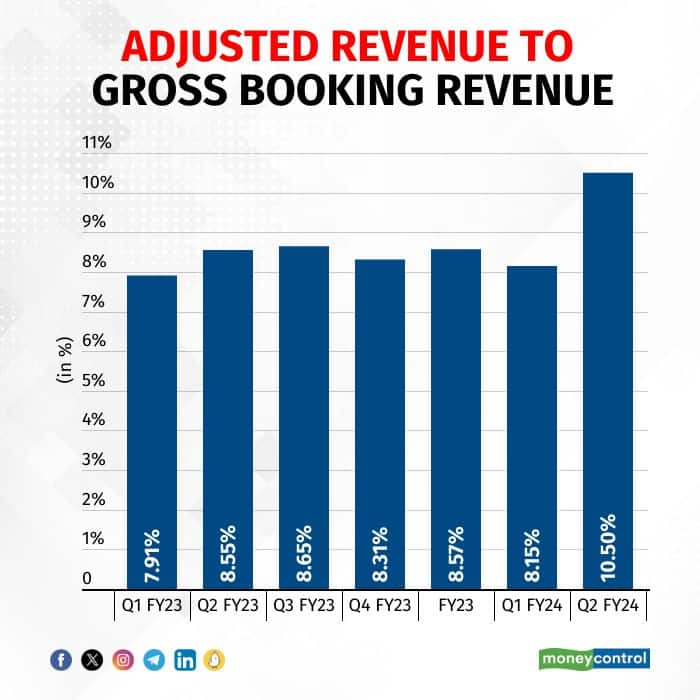

In addition to improving profitability, the company moved away from its long-held practice of not charging convenience fees to selectively charging convenience fees. This, to an extent, helped to improve the realised revenue as take rates (commission) of airlines are getting competitive.

Source: Company

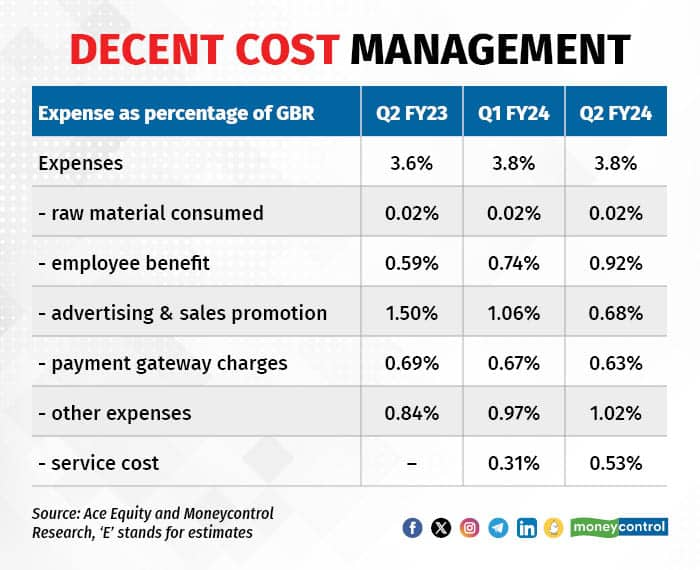

Focus back on cost management

EaseMy Trip’s USP (unique selling proposition) has been its management of costs. The company’s expenditure-to-GBR is the lowest in the industry. However, in a bid to gain market share, advertisement and sales promotion expenses were increasing. In Q2, with the focus back on profitability, there was a significant moderation in promotional expenses.

Source: Company

Source: Company

Airline-driven business

The company has forayed overseas, started setting up offline stores, and has done a slew of acquisitions such as Spree Hospitality, Yolobus, Nutana Aviation and cheQin. The list got longer with three more acquisitions: Guideline Travel Holidays, Mumbai; TripShope Travel Technologies, Kashmir; and Dook Travels. However, the acquisitions are yet to move the needle on the overall financials. The share of air ticket booking is 82 percent of revenue and 93 percent of earnings as the company is pushing other businesses like hotels with heavy discounts.

Receivable a short-term problem to reckon with

The company has given a guidance of Rs 250 crore profit before tax (PBT). The PBT for the first half was Rs 100 crore, thereby pointing to a stronger second half in terms of profitability. While that’s good news, investors got to be mindful of the impending risk of a large provision that could come as EMT has an outstanding receivable of over Rs 72 crore from Go Air. This remains a near-term overhang.

While the earnings growth in mid-twenties remain decent, we are wary of the market share loss and the impending provision. We still find the valuation costly as the positive sector tailwinds are somewhat offset by the competitive intensity. We remain Equal-weight and await some correction to enter the stock to ride the earnings story.

Source: Company

Source: Company

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now