Highlights

Coromandel Q2FY24

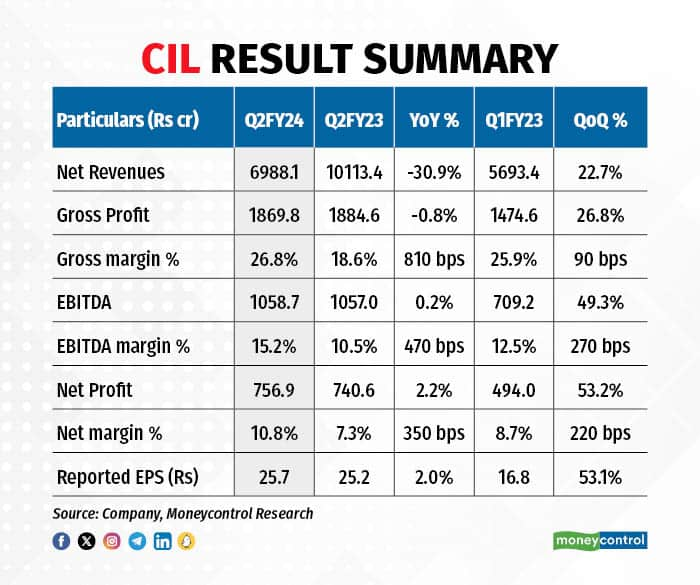

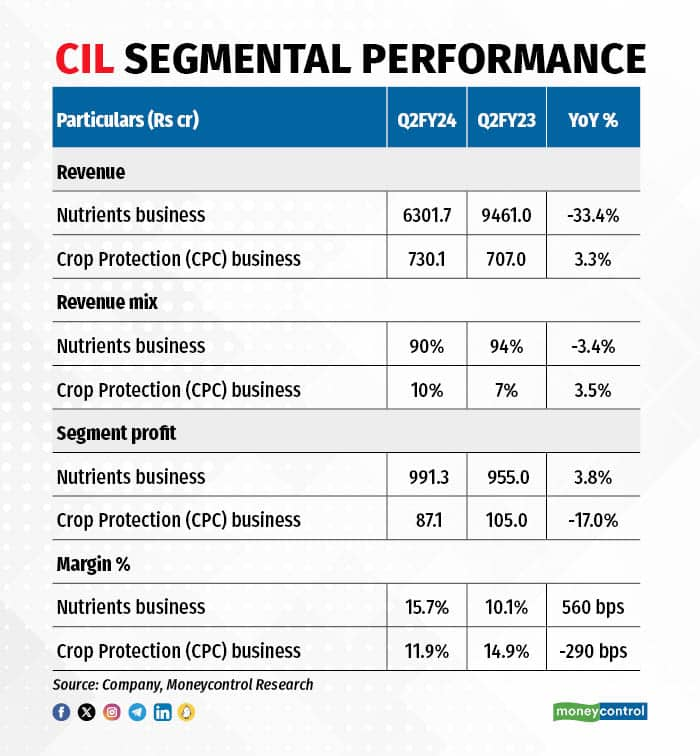

Consolidated revenues in Q2FY24 fell 30 percent year on year (YoY). The company's key operating markets in the south were impacted by a sub-normal monsoon that affected the off-take of agri inputs. The revised lower Kharif subsidy rates further impacted the top line.

However, lower input costs coupled with backward integration benefits helped to improve the gross margin by 810 bps (basis points) and the EBITDA (earnings before interest, tax, depreciation, and amortisation) margin by 470 bps YoY.

The CPC (crop protection) business was better with a 3 percent growth in revenue, driven by healthy sales in its formulations business. However, channel inventory and soft commodity prices kept realisations under check.

Paradeep’s Q2FY24

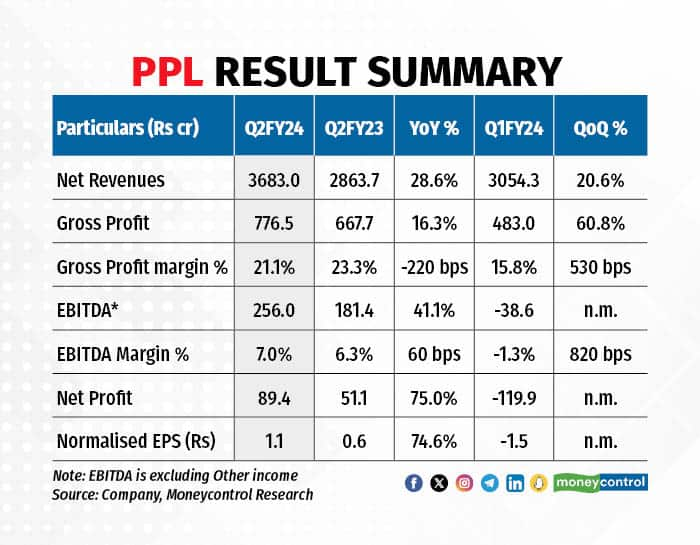

Revenues were up 29 percent YoY even on a very high base of last year. Supported by increased capacity, sales volume of finished fertilisers surged 78 percent YoY to 807,000 tonnes in Q2 vis-à-vis 454,000 tonnes last year. Moreover, the EBITDA grew 41 percent YoY and the EPS improved by 75 percent YoY.

Overall, the Q2 performance was primarily driven by incremental volumes from the Goa plant as the company was able to leverage its brands – Jai Kisaan and Jai Kisaan Navratna – to generate higher sales in a particularly challenging market environment.

PPL was also able to reduce its short-term debt by Rs ~730 crore due to higher subsidy receivables. Its total debt/equity ratio stood at 1.1x at the end of H1FY24 vs 1.3x at FY23.

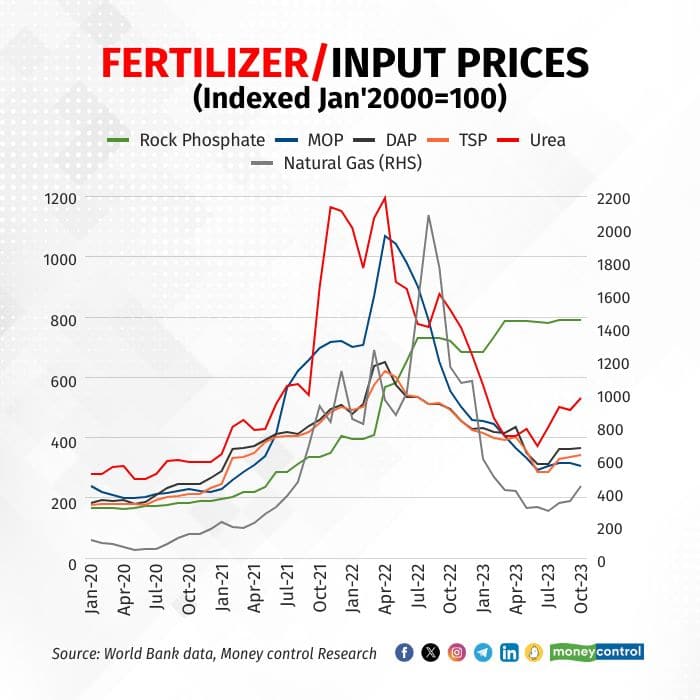

Raw material prices have stabilised

By the end of July, the prices of imported fertilisers and raw materials had fallen ~60 percent from their peak levels. Prices seem to have stabilised now, while a few of them have started moving up again August onwards due to some supply-side issues.

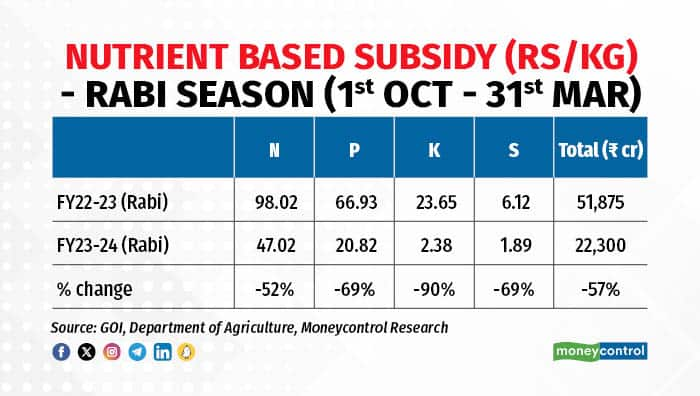

Subsidy cut

Following the falling input prices, the Union Cabinet has approved the Nutrient Based Subsidy of Rs 22,300 crore for the upcoming Rabi season (October 2023 – March 2024), which has been reduced by ~57 percent against Rs 51,875 crore subsidy last year.

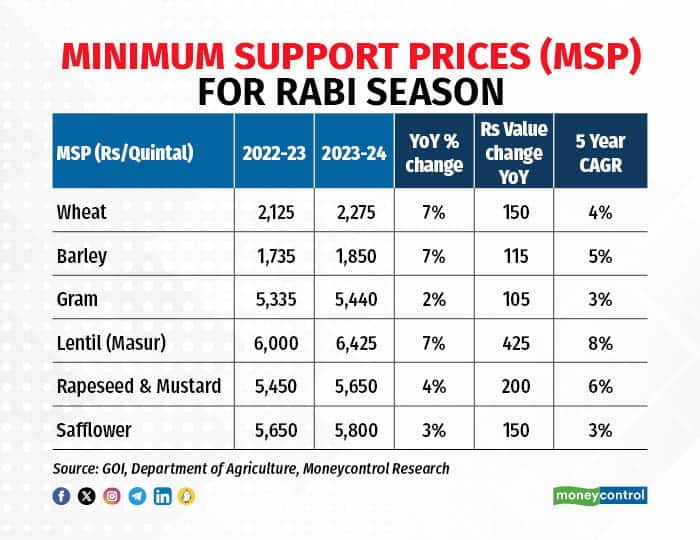

On the other hand, the MSP for the upcoming Rabi season has been declared with a 3-7 percent increase taken across commodities. This should bode well for farmers’ income and agri-input demand.

Crop protection chemicals market is slowly normalising

The market environment has been quite challenging for agri-input producers – with high channel inventory, lower subsidies, and a delayed monsoon.

However, the ground level demand remains robust. On a year-to-date basis (until Oct ’23), the consumption volume – indicated by the POS (Point of sales) – stood at 128.2 lakh metric tonnes against 103.7 lakh metric tonnes last year, up 24 percent YoY.

Besides, the IMD has forecast a normal Northeast monsoon, which should augur well for the Rabi season’s agro-input demand.

Better realisation for niche products

The normalisation of raw material prices and a consequent decrease in subsidy rates should rationalise MRPs of most generic fertilisers.

However, better pricing could be realised for the unique grades of complex fertilisers — such as NPK-28 that only CIL and PPL manufacture and NPK-19 that only PPL’s Goa plant produces in the country.

Outlook

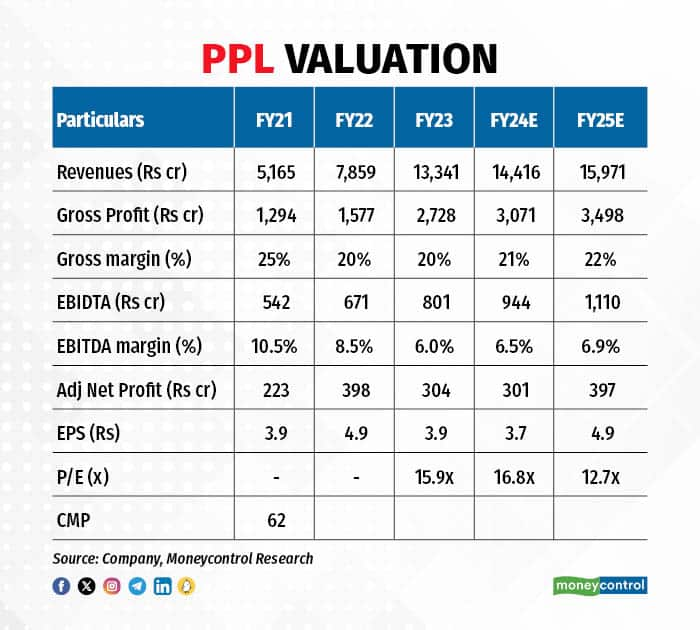

Starting this fiscal, Paradeep Phosphates should see a lot of efficiencies kicking in from its backward integration investments. The management expects ~Rs 200 crore of additional annual EBITDA to be generated from all these initiatives. We think PPL has a solid footing to remain cost competitive and become a much larger player in the complex fertiliser space.

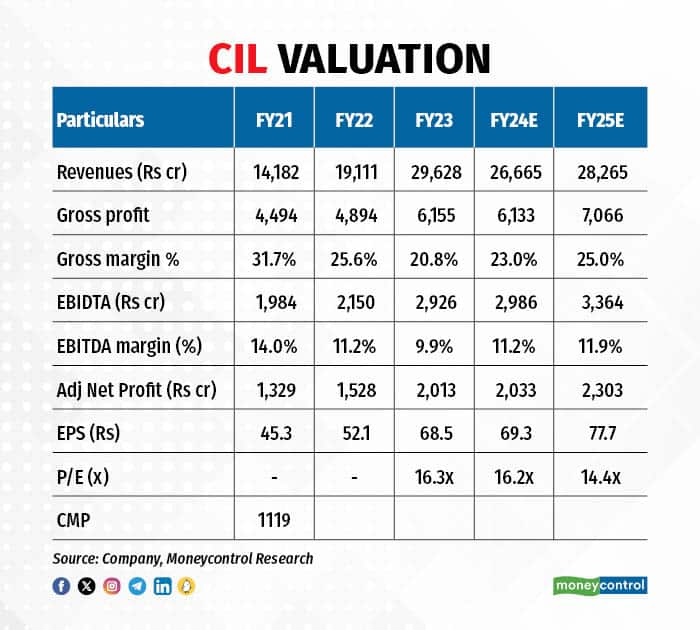

On the other hand, Coromandel’s next phase of growth will come from its CDMO as well as the specialty and industrial chemicals domains. CIL would invest ~Rs 1,000 crore in these new businesses over the next 18-24 months. Thereafter, the company expects ~Rs 2,000-3,000 crore of peak revenue from these initiatives.

Valuation

At a P/E of ~13x its FY25e, PPL is trading in line with its closest peer in the non-urea space (Coromandel International), which is trading at ~14x. We see much more room on the upside and recommend accumulating both CIL and PPL for long-term investment.

Key risk to watch

As on November 9, 2023, the country’s reservoir level stood 20 percent lower than last year. This could dampen sowing activities in the Rabi season. Thus, the Northeast monsoon will be a key factor to watch.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now