Policyholders aren't sticking with life insurers for long

Policyholders aren't sticking with life insurers for long

India’s life insurance companies have had the best run since the pandemic hit in 2020. Indeed, faced with a threat to their lives, people realised insurance of both health and life is critical for financial wellbeing. The profitability of listed life insurers has been on a long upswing for the past three years, thanks to speedy business growth post pandemic.

A pertinent question to ask, though, is whether this growth is sustainable. The usual arguments of low penetration, and scope for greater adoption of term policies give enough credence to the argument that life insurers have a long runaway for business and profitability growth. But there is a metric that shows that insurers have their task cut out in achieving sustainable profitability.

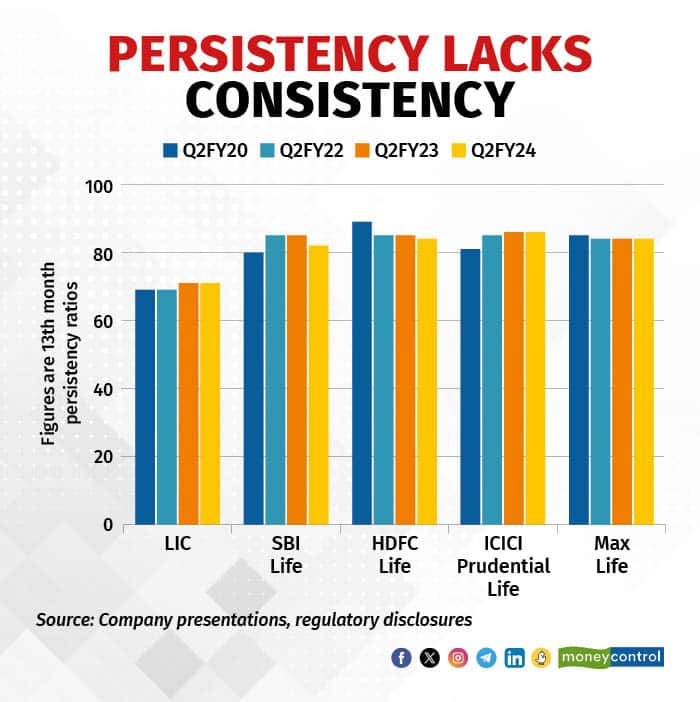

Life insurance is a product where the cost of acquisition and servicing of a customer is taken on by the insurer upfront while the insurer’s profit depends on how long the individual sticks with the company. This is measured by the persistency ratio which is essentially how many policyholders continue to pay their premiums until the end. As the above chart shows, the picture on persistency is mixed. The insurance whale, Life Insurance Corporation of India (LIC) has the lowest persistency ratio among listed peers. In other words, LIC sees a higher number of customers abandon its policies than its private sector peers. What this means for LIC is that the insurer takes on the upfront cost of underwriting every policy but ends up earning profits only on 71 percent of the premiums because nearly a third of its policyholders exit.

But SBI Life Insurance Company Ltd, and Max Life Insurance have managed to improve marginally on persistency ratios. HDFC Life Insurance Company Ltd witnessed a decline in persistency since the pandemic while ICICI Prudential Life Insurance Company Ltd reported a sizeable improvement.

Insurers have tweaked their product mix, chased simpler term policies, launched products customised for different consumer segments but persistency ratios haven’t improved significantly. For some, it has declined. This does not augur well for profits and by extension the embedded value which is the key gauge for valuation.

Another aspect to note is that persistency ratios decline as one proceeds further in the life of the policy. The regulator mandates that life insurers disclose the persistency ratio of the 13th, 25th, 37th, 49th and 61st month. The persistency ratio for the 61st month is near 60 percent for most insurers. Simply put, more than 40 percent of policyholders stop paying premiums after the fifth year. This is detrimental not only for policyholders but also for life insurers.

Life insurance companies must up their game when it comes to persistency ratios. Improvement in the longer tenure persistency ratios is the only way to guarantee a sustainable path to profitability.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now