Shares of Bajaj Finance plunged two percent to close at Rs 7,219 on November 17 after the Reserve Bank of India (RBI) increased the risk weight on consumer credit exposure of non-banking financial corporations (NBFCs) to 125 percent from 100 percent earlier.

This move would directly impact Tier-1 capital of NBFCs, especially Bajaj Finance, 45 percent of whose loan book comprises unsecured retail exposure, said analysts.

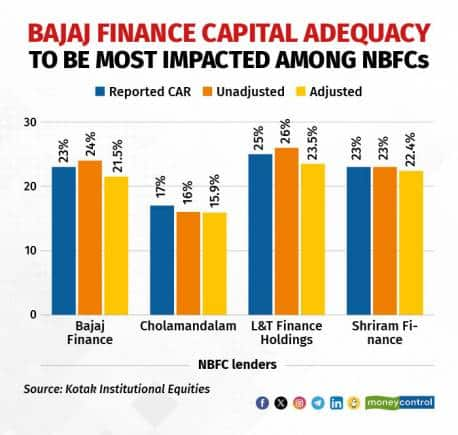

Analysts at CLSA expect a 230 basis points (bps) reduction in Tier-1 capital of Bajaj Finance, while Citi pegged an over 190 bps impact on the lender’s capital adequacy ratio (CAR).

A lower CAR limits growth for lending institutions as they need to maintain capital to lend more, as required by the RBI. Inadequate capital hurts financial institutions’ capacity to deal with unexpected losses from bad loans.

ALSO READ: Decoding RBI credit risk weight impact across banks, NBFCs; how each lender will lose, gain

Bajaj Finance will need to augment capital adequacy, raise funds

Also, it has a smaller share of priority sector lending as compared to other vehicle finance competitors such as Mahindra & Mahindra Finance and Cholamandalam Finance. This makes it more vulnerable due to higher capital adequacy requirements, said Kotak Institutional Equities.

Thus, in order to maintain a healthy CAR with the Central Bank, Bajaj Finance would need to raise adequate capital to be able to grow its lending book (see table of Bajaj Finance CAR vs peers).

A fresh capital raise by NBFCs from banks would increase their borrowing costs, as even the banks’ lending to NBFCs is set to get expensive owing to the RBI risk-weight measures.

Bajaj Finance has 32 percent of its funding from bank borrowings.

ALSO READ: Why RBI cracking whip on consumer loans is no surprise

Rising cost of funds may deter Bajaj Finance’s growth path

Hence, fresh capital raise and heavy priced loans may impact the margin of most asset financing NBFCs as cost of funds would ultimately inch up, warned analysts at Emkay Global.

Bajaj Finance already witnessed an increase in the cost of funds in the July-September quarter (Q2FY24) that dented net interest margins (NIMs) of the consumer lender by 14 bps sequentially.

“Alongside a 14 bps QoQ contraction in margins, the rising cost of funds may pressure profits, challenging the company's ability to sustain robust earnings growth,” said Anirudh Garg, Partner and Head of Research at Invasset PMS.

NBFCs such as Bajaj Finance would face higher costs due to expensive bank funding and higher capital requirements, and hence will need to pass it on via higher lending rates, said Morgan Stanley.

ALSO READ: Banks, NBFCs may raise rates after RBI’s action on consumer loans, experts say

Product ban amplifies trouble

That apart, the RBI’s ban on Bajaj Finance’s loan issuance under two products – eCOM and Insta EMI Card is also expected to hinder the consumer lender’s ability to lend and grow.

Valuation-wise, Bajaj Finance is trading at 34.09 times (x) price-to-earnings (PE) ratio, much higher than sector’s average of 20x PE multiple, suggested data.

Analysts highlight that the company’s needs to grow at a faster rate to justify its valuations or it might face some correction going ahead.

“Bajaj Finance is already trading at expensive valuations compared to peers. I wonder if growth will be possible in the coming quarters for the rest of the fiscal year 2023-24 and justify its valuations. If Bajaj Finance does not grow at a 30-35 percent compounded annual growth rate (CAGR) in H2FY24, the valuations would not be sustainable,” said AK Prabhakar, Head of Research, IDBI Capital.

The altered risk weights, coupled with margin contractions and increased cost of funds, pose challenges for Bajaj Finance's earnings profile and may reshape lending patterns within the NBFC sector.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!