Highlights

Xi-Biden talks – symbolic or strategic?

The meeting of Xi Jinping and Joe Biden on the sidelines of the APEC summit has led to the resumption of military level communication after a gap of one year. The communications broke down when US Speaker Nancy Pelosi visited Taiwan last year. This meet comes at a time when there are several flash points — Ukraine, Taiwan, Israel-Hamas war – that can flare up any moment. As Biden puts it rightly, “a lack of communication was how accidents happen".

This sets the tone for the engagements between the two superpowers in this interesting phase of de-globalisation. What may make follow-up talks more interesting is the probability of Trump making a comeback in 2024 Presidential election. That scenario itself may prompt China to make some early concessions. However, it is too early to draw any tangible mileage from these talks, except for the expectations that conflicts across the globe could remain localised if these countries are working in sync.

Trade talks, if any in 2024, may lead to the easing of some trade barriers on both sides. While we don’t expect reversal in the China Plus one trend, in times of global recession, economics may take a precedence over politics.

Overall, such talks can potentially moderate equity risk premium. That said, we are living in a time when elevated risk-free rate is a much bigger concern.

When can yield curve gravitate down sustainably?

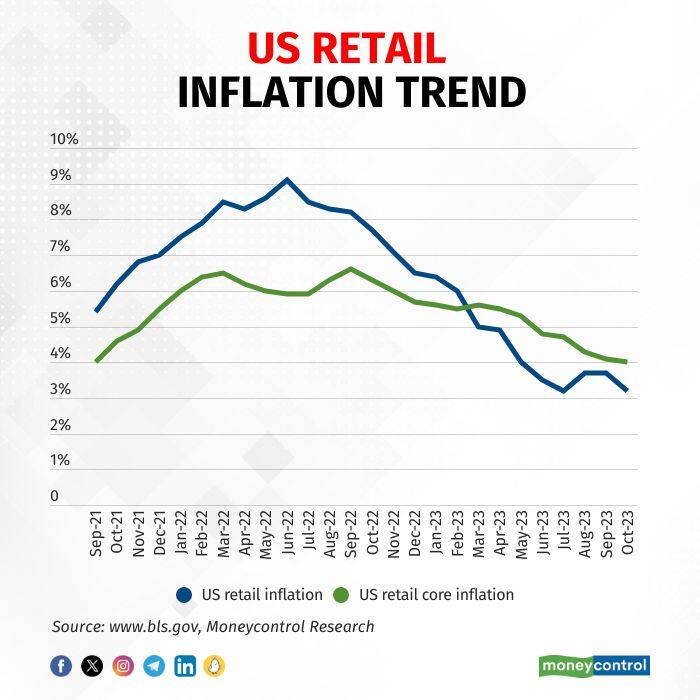

Favourable non-farm payrolls and inflation data did bring the US 10-year treasury yield down by about 55 basis points. The unemployment rate has ticked up to 3.9 percent from 3.4 percent in April ’23 and the headline retail inflation in the US has come down to 3.2 percent against 7.7 percent last year.

That said, the 10-year yield is still elevated at about 4.45 percent. The US Fed funds rate has been kept at 5.25-5.5 percent since July ’23 and expected to remain so for the next six months at least. While the Street expects rate cuts in H2 CY24, the year-end risk-free rate is still expected to be about 4.8 percent next year.

Also read: What should investors do after Fed's latest policy call?

The reason behind this “higher for longer” narrative for interest rates lies in the elevated core inflation of 4 percent – 2x the central bank’s comfort level.

While goods inflation has moderated, service inflation is sticky and strong and has a lot to do with strong consumption trends. Further, what adds to elevated yields, is the huge supply of bonds from both the Fed and the Treasury, causing a demand-supply mismatch.

To cut a long story short, a sustainable drop in yields is a function of credible drop in demand-led inflation.

Can oil derail dis-inflation efforts?

Oil prices have recently receded from $90 on an inventory build-up in the physical market and the fear of a demand slowdown.

Further, the Middle East crisis doesn’t appear to be spreading. Therefore, there should be no impact on oil prices. In Europe, Russian oil exports continue and the success of the upcoming EU sanctions appears to be low.

Despite the recent softness in prices, investment in oil remains at a multi-year low which creates a bull case for oil prices in 2024. Oil prices are expected to be in the $80-85 range as long as OPEC doesn’t bring in more oil to the market or there is a slump in demand.

Takeaways

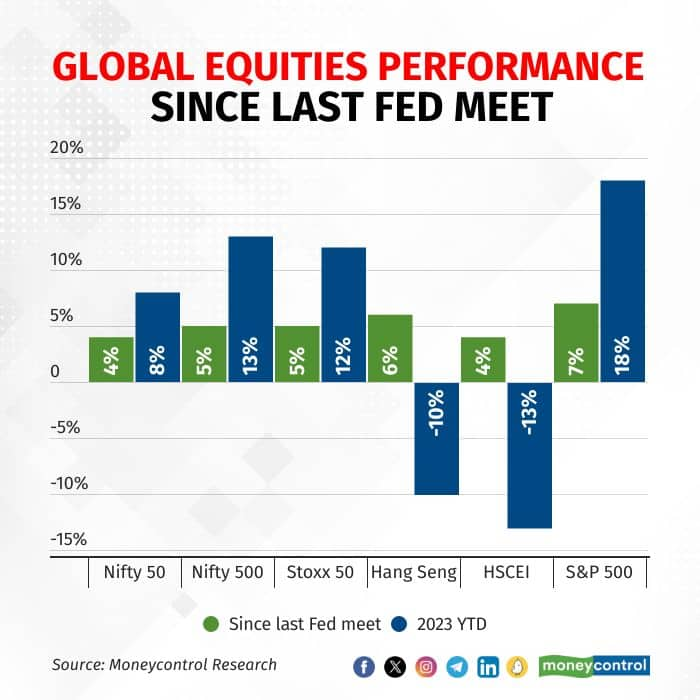

Recent developments have clearly refuelled global equities (Including China - HSCEI). Since the Fed meet, the benchmark indices are up 4-7 percent. This is nearly 50 percent of the growth seen in CY23.

The Nifty, Stoxx 50, and S&P 500 are all within the striking distance of all-time highs and appear to be pricing in a soft-landing — and that is the biggest risk for the markets. A soft-landing is not yet certain, given that there is massive cumulative monetary tightening – the impact of which is yet to be seen. Further, central banks would continue to engineer slowdown to bring inflation further down.

At the same time, valuations are not sober even after time correction of about two years for most of the markets. It is relevant to note that there has been substantial earnings downgrades – particularly for global cyclicals. Further, prospects of lower liquidity support for equities makes the case weaker. Other than the quantitative tightening, liquidity support for equities will go thin as global funds would be tempted to lock elevated treasury rates.

Therefore, we still have to be careful about picking stocks and finding sectors (travel, discretionary consumption), trends (EMS outsourcing, renewables), and geographies (domestic) that have resilient earnings prospects. Our selection of stocks for the recent Diwali Portfolio is a testament to these assumptions.

Follow author on twitter @anubhavsays. For more research articles, visit our Moneycontrol Research page.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Moneycontrol Pro Panorama | Investors rediscover Coal India

Nov 17, 2023 / 03:04 PM IST

In today's edition of Moneycontrol Pro Panorama: Nifty fiscal earnings may outpace last year, slowing inflation a good omen for in...

Read Now

Moneycontrol Pro Weekender: Crystal ball gazing

Nov 18, 2023 / 09:51 AM IST

It's that time of the year when economists and market strategists start making their forecasts for the year ahead

Read Now